Compute the child and dependent care credit in each of the following independent cases: a. Jack and

Question:

Compute the child and dependent care credit in each of the following independent cases:

a. Jack and Jill Jones are married and file a joint return. Jill worked full time earning $20,000, while Jack attended law school the entire year. They incurred $6,500 of child care expenses during the year for their two children, ages eight and six.

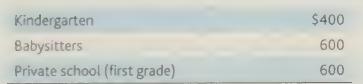

b. Mary Morgan is a widow who worked full time the entire year earning $23,000. She incurred the following child care expenses for her six-year-old daughter in order to be employed during the year:

c. Bill and Debra Page are divorced and have one dependent child, Betty, age nine. Bill had custody of Betty for five months this year and claimed Betty as an exemption on his tax return. Debra had custody of Betty for the remainder of the year. Debra incurred $3,600 of employment-related expenses during the year, while Bill incurred $2,500 of employment-related expenses. Both were employed for the entire year and each earned $20,000 in wages this year.

Step by Step Answer:

CCH Federal Taxation Basic Principles 2020

ISBN: 9780808051787

2020 Edition

Authors: Ephraim P. Smith, Philip J. Harmelink, James R. Hasselback