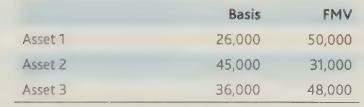

Elbegone Partnership had the following assets when one of its partners sold her interest in the partnership:

Question:

Elbegone Partnership had the following assets when one of its partners sold her interest in the partnership:

Asa result of the sale of one of the partnership interests, Elbegone is required to make a $21,000 adjustment to the basis of its assets under Section 743(b).

a. Determine the appropriate allocation of the basis adjustment among the partnership's assets.

b. How would your answer change if the value of asset 2 had been $57,000, rather than $31,000?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

CCH Federal Taxation Basic Principles 2020

ISBN: 9780808051787

2020 Edition

Authors: Ephraim P. Smith, Philip J. Harmelink, James R. Hasselback

Question Posted: