Elm Corporation has 100 shares of stock outstanding of which Oak Corporation owns 75 shares with a

Question:

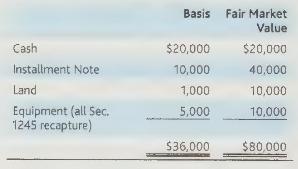

Elm Corporation has 100 shares of stock outstanding of which Oak Corporation owns 75 shares with a basis of \(\$ 10,000\), and Sherman Forest owns 25 shares with a basis of \(\$ 30,000\). Elm Corporation has a \(\$ 50,000\) net operating loss carryover and the following assets (all held long-term):

a. What are the tax consequences if Elm Corporation adopts a plan of complete liquidation and distributes the \(\$ 20,000\) cash to Sherman and all its remaining assets to Oak Corporation?

b. As an alternative, what are the tax consequences if Elm Corporation distributes \(\$ 20,000\) cash to Sherman in redemption of his 25 shares, and 10 days later, Elm adopts a plan of complete liquidation and distributes its remaining assets to Oak Corporation? What are Elm and Oak trying to accomplish through the redemption of Sherman's shares?

Step by Step Answer:

CCH Federal Taxation 2019 Comprehensive Topics

ISBN: 9780808049081

2019 Edition

Authors: Ephraim P. Smith, Philip J. Harmelink, James R. Hasselback