For the current month, Jackson Cement Co. incurred payroll expenses as follows: a. What amount can Jackson

Question:

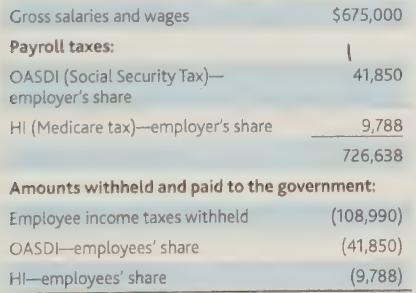

For the current month, Jackson Cement Co. incurred payroll expenses as follows:

a. What amount can Jackson claim as a tax deduction for salary and wage expense?

b. How much can Jackson deduct as tax expense?

Transcribed Image Text:

Gross salaries and wages Payroll taxes: OASDI (Social Security Tax)-- employer's share HI (Medicare tax)-employer's share $675,000 1 41,850 9,788 726,638 Amounts withheld and paid to the government: Employee income taxes withheld OASDI-employees' share HI-employees' share (108,990) (41,850) (9,788)

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (2 reviews)

The tax expense that Jackson can deduct includes the employers share of payroll taxes ...View the full answer

Answered By

Albert Kinara

i am an expert research writer having worked with various online platform for a long time. i also work as a lecturer in business in several universities and college part time and assure you well researched and articulate papers. i have written excellent academic papers for over 5 year and have an almost similar experience experting many clients in different units. bachelor of commerce (finance)

masters in strategic management

phd finance

4.60+

26+ Reviews

48+ Question Solved

Related Book For

CCH Federal Taxation Basic Principles 2020

ISBN: 9780808051787

2020 Edition

Authors: Ephraim P. Smith, Philip J. Harmelink, James R. Hasselback

Question Posted:

Students also viewed these Business questions

-

Start of Payroll Project 7-3a October 9, 20-- No. 1 The first payroll in October covered the two workweeks that ended on September 26 and October 3. This payroll transaction has been entered for you...

-

The first payroll in October covered the two workweeks that ended on September 26 and October 3. This payroll transaction has been entered for you in the payroll register, the employees' earnings...

-

Which form of business organization is limited by the Internal Revenue Code (IC) concerning the number and type of shareholders? A partnership An S corporation A C corporation A sole proprietorship...

-

The annual revenues associated with several large apartment complexes are $300, $450, $425, $50, $75, and $150 for years 0, 1, 2, 3, 4, and 5, respectively. Determine the net cash flow and whether...

-

Burnitz Manufacturing Company was organized on January 1, 2014. During 2014, it has used in its reports to management the straight-line method of depreciating its plant assets. On November 8, you are...

-

Q2 Internal financial planners forecast Wooten Sims LLC's sales to increase by 4% next year Current sales are $562 million Total operating assets in the current period are 1,200 million ($1.2...

-

Forecasting movie revenues with Twitter. Refer to the IEEE International Conference on Web Intelligence and Intelligent Agent Technology (2010) study of how social media (e.g., Twitter.com) may...

-

Dunlop Company makes a product that it sells for $200. Dunlop incurs annual fixed costs of $250,000 and variable costs of $160 per unit. Required The following requirements are interdependent. For...

-

Required information Acoma Co, has identified one of its cost pools to be quality control and has assigned $281.400 to that pool. Number of Inspections has been chosen as the cost driver for this...

-

Two years ago, Jack Peters borrowed $150,000 from the First National Bank which he used to buy equipment used in his business. Business slowed considerably this year, and Jack was unable to make...

-

Indicate whether the following expenditures are deductible for AGI, from AGI or not deductible. a. Medical expenses of individual taxpayer b. Safe deposit box rental for business c. Interest expense...

-

(a) What are the legal rights and obligations of various parties under several real estate and lending agreements, such as a ground lease, a letter of intent, and a construction loan? (b) Is it...

-

Consider the expression timing is everything in relation to the building of the TOMS brand. Besides the influence of recovering economic conditions and the increased affluence of potential customers,...

-

What is corporate strategy and why is it important? Choose a company with which you are familiar, and evaluate its corporate strategy, especially in regards to financial strategies. What are some...

-

Assignment Tasks: Review the following situations and for each pay period determine the employee's net pay by calculating what earnings & benefits are subject to Income Tax, Canada / Quebec Pension...

-

sample letter for signature change on bank accounts for principals of school

-

Use Excelshowing all work and formulasto complete the following: Prepare a flexible budget. Compute the sales volume variance and the variable cost volume variances based on a comparison between...

-

What decisions are made by marketing managers? How does marketing research help in making these decisions?

-

A circular concrete shaft liner with Youngs modulus of 3.4 million psi, Poissons ratio of 0.25, unconfined compressive strength 3,500 psi and tensile strength 350 psi is loaded to the verge of...

-

What is an agent wholesalers marketing mix?

-

Why do you think that many merchant wholesalers handle competing products from different producers, while manufacturers agents usually handle only noncompeting products from different producers?

-

What alternatives does a producer have if it is trying to expand distribution in a foreign market and finds that the best existing merchant wholesalers wont handle imported products?

-

An underlying asset price is at 100, its annual volatility is 25% and the risk free interest rate is 5%. A European call option has a strike of 85 and a maturity of 40 days. Its BlackScholes price is...

-

Prescott Football Manufacturing had the following operating results for 2 0 1 9 : sales = $ 3 0 , 8 2 4 ; cost of goods sold = $ 2 1 , 9 7 4 ; depreciation expense = $ 3 , 6 0 3 ; interest expense =...

-

On January 1, 2018, Brooks Corporation exchanged $1,259,000 fair-value consideration for all of the outstanding voting stock of Chandler, Inc. At the acquisition date, Chandler had a book value equal...

Study smarter with the SolutionInn App