Genesis Inc. was formed in 2016. Its current E&P and distributions to shareholders made each year are

Question:

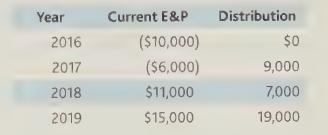

Genesis Inc. was formed in 2016. Its current E&P and distributions to shareholders made each year are listed below.

What is Genesis Inc.'s year-end accumulated E&P (after the distributions) at the end of each year and what is the tax status of each distribution?

Transcribed Image Text:

Year 2016 2017 2018 2019 Current E&P ($10,000) ($6,000) $11,000 $15,000 Distribution $0 9,000 7,000 19,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 0% (1 review)

Answer To calculate Genesis Incs yearend accumulated EP Earnings and Profits and determine the tax status of each distribution you need to follow thes...View the full answer

Answered By

Joseph Mwaura

I have been teaching college students in various subjects for 9 years now. Besides, I have been tutoring online with several tutoring companies from 2010 to date. The 9 years of experience as a tutor has enabled me to develop multiple tutoring skills and see thousands of students excel in their education and in life after school which gives me much pleasure. I have assisted students in essay writing and in doing academic research and this has helped me be well versed with the various writing styles such as APA, MLA, Chicago/ Turabian, Harvard. I am always ready to handle work at any hour and in any way as students specify. In my tutoring journey, excellence has always been my guiding standard.

4.00+

1+ Reviews

10+ Question Solved

Related Book For

CCH Federal Taxation Basic Principles 2020

ISBN: 9780808051787

2020 Edition

Authors: Ephraim P. Smith, Philip J. Harmelink, James R. Hasselback

Question Posted:

Students also viewed these Business questions

-

Genesis Inc. was formed in 2015. Its current \(\mathrm{E} \& \mathrm{P}\) and distributions to shareholders made each year are listed below. What is Genesis Inc.'s year-end accumulated \(E \& P\)...

-

Genesis Inc. was formed in 2015. Its current E&P and distributions to shareholders made each year are listed below. Year Current E&P Distribution 2015 ($10,000) $0 2016 ($6,000) $9,000 2017...

-

The following additional information is available for the Dr. Ivan and Irene Incisor family from Chapters 1-5. Ivan's grandfather died and left a portfolio of municipal bonds. In 2012, they pay Ivan...

-

Why is there currently an even greater need for effective employee communications?

-

What are the main contents of the strategic report?

-

Two infinite lines of charge are parallel to and in the same plane as a z axis. One, of charge per unit length + , is a distance a to the right of this axis. The other, of charge per unit length ,...

-

Assuming that MNC entered into no forward contract, how much foreign exchange gain or loss should it report on its 2009 income statement with regard to this transaction? LO9 a. $5,000 gain. b. $3,000...

-

An experiment was conducted to investigate leaking current in a SOS MOSFETS device. The purpose of the experiment was to investigate how leakage current varies as the channel length changes. Four...

-

The cost of utilities depends on how many wards the hospital needs to use during a particular month. During months with activity under 2 , 0 0 0 patient days of care, two wards are used, resulting in...

-

Door Co.'s taxable income was $1,000,000 this year and it paid $210,000 in federal income taxes. Related information for the year follows: $4,000 fines (not deducted to compute taxable income) ...

-

Given the following information, determine the taxable portion and return of capital in each situation, as well as accumulated E&P on January 1, 2020. 2019 Current E&P a. $75,000 b. 75,000 75,000...

-

A bank manager notices that by the time customers get to the teller, they seem irritated and impatient. She wants to investigate the problem further, so she hires you to design a research project to...

-

a) Discuss whether bike paths can be considered a public good. Now consider a hypothetical town. Suppose that there are three equal-size groups in the economy with the following demand curves: Group...

-

Event services and management can be a lucrative revenue generator. What are the two most important factors in developing a successful event service and management business, whether it is independent...

-

Show how the buying process occurs in the consumer. Review some of the steps in the buying process, stories like: felt need pre-purchase activity purchase decision Post-purchase feelings Explain and...

-

How did Henry Ford set the stage for some of the same problems we still face today in employee relations, especially in manufacturing? 2) If you were a human resources manager, how would you address...

-

What does a DMO risk by not having a positioning theme? Critique the potential of your destination's slogan to effectively differentiate against rivals. you have been asked by a television network to...

-

Suppose there are two countries, Busytown and Lazyasiwannabe, with the following production possibility tables: a. Draw the production possibility curves for each country. b. Which country has the...

-

Michelles trust is subject to 3.8% surtax on the lesser of the trusts net investment income or the excess of the trusts adjusted gross income over the $12,400 threshold (the highest trust tax rate)....

-

Ten Pins Manufacturing has 6.4 million shares of common stock outstanding. The current share price is $59, and the book value per share is $4. The company also has two bond issues outstanding. The...

-

Given the following information for Cleen Power Co., find the WACC. Assume the companys tax rate is 35 percent. Debt: 7,000 6 percent coupon bonds outstanding, $1,000 par value, 20 years to maturity,...

-

Makai Metals Corporation has 9.1 million shares of common stock outstanding and 230,000 6.2 percent semiannual bonds outstanding, par value $1,000 each. The common stock currently sells for $41 per...

-

(15 points) Stressed $2.500,000 of S% 20 year bands. These bonds were issued Jary 1, 2017 and pay interest annually on each January 1. The bonds yield 3% and was issued at $325 8S! Required (2)...

-

Packaging Solutions Corporation manufactures and sells a wide variety of packaging products. Performance reports are prepared monthly for each department. The planning budget and flexible budget for...

-

1. A company issued 10%, 10-year bonds with a par value of $1,000,000 on January 1, at a selling price of $885,295 when the annual market interest rate was 12%. The company uses the effective...

Study smarter with the SolutionInn App