If Doria Oliva dies this year (2018), what estate tax is payable if the facts are: Adjusted

Question:

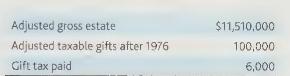

If Doria Oliva dies this year (2018), what estate tax is payable if the facts are:

Transcribed Image Text:

Adjusted gross estate $11,510,000 Adjusted taxable gifts after 1976 Gift tax paid 100,000 6,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 0% (1 review)

Based on the information you provided heres an estimation of Doria Olivas potential estate tax in 20...View the full answer

Answered By

Asim farooq

I have done MS finance and expertise in the field of Accounting, finance, cost accounting, security analysis and portfolio management and management, MS office is at my fingertips, I want my client to take advantage of my practical knowledge. I have been mentoring my client on a freelancer website from last two years, Currently I am working in Telecom company as a financial analyst and before that working as an accountant with Pepsi for one year. I also join a nonprofit organization as a finance assistant to my job duties are making payment to client after tax calculation, I have started my professional career from teaching I was teaching to a master's level student for two years in the evening.

My Expert Service

Financial accounting, Financial management, Cost accounting, Human resource management, Business communication and report writing. Financial accounting : • Journal entries • Financial statements including balance sheet, Profit & Loss account, Cash flow statement • Adjustment entries • Ratio analysis • Accounting concepts • Single entry accounting • Double entry accounting • Bills of exchange • Bank reconciliation statements Cost accounting : • Budgeting • Job order costing • Process costing • Cost of goods sold Financial management : • Capital budgeting • Net Present Value (NPV) • Internal Rate of Return (IRR) • Payback period • Discounted cash flows • Financial analysis • Capital assets pricing model • Simple interest, Compound interest & annuities

4.40+

65+ Reviews

86+ Question Solved

Related Book For

CCH Federal Taxation 2019 Comprehensive Topics

ISBN: 9780808049081

2019 Edition

Authors: Ephraim P. Smith, Philip J. Harmelink, James R. Hasselback

Question Posted:

Students also viewed these Business questions

-

If Doria Oliva dies this year (2019), what estate tax is payable if the facts are: Adjusted gross estate Adjusted taxable gifts after 1976 Cift tax paid $11,710,000 100,000 6,000

-

The GASB has identified four classes of non-exchange revenues: Derived tax Imposed Government mandated Voluntary For each of the following revenue transactions affecting a city, identify the...

-

1. Hannah is applying for a life policy on her girlfriend Sarahs life. The policy is $500,000 and carries a large premium. Hannah is the main earner, so she is concerned about not being able to pay...

-

(a) Victor and Maria regularly buy and sell a number of items on eBay, Craig's List, and through the free community newspaper, from which they earn about $4,000 each year. What is the accumulated...

-

Key comparative figures for Apple and Google follow. Required 1. Compute the dollar amount of gross margin and the gross margin ratio for the two years shown for each of these companies. 2. Which...

-

The element polonium crystallizes in a cubic system. Bragg reflections, with X-rays of wavelength 154 pm, occur at sin = 0.225, 0.316, and 0.388 from the (100), (110), and (111) sets of planes. The...

-

What concept underlies the two-transaction perspective in accounting for foreign currency transactions? LO9

-

Prepare a performance report for the dining room of Leonardos Italian Cafe´ for the month of February 2011, using the followingdata: Budgeted Data: Dining room wages.. Laundry and housekeeping....

-

Use these present value factors to answer the following question: What amount should be deposited in a bank today to grow to $10600 three years from today?...

-

Because John was so happy that Dana had agreed to become his fiancee, on February 2, 2018, he gave Dana's mother, Ethel, \(\$ 15,000\) in cash. a. Does this gift qualify for gift-splitting? b. Does...

-

Beta Corporation terminates its \(S\) election at the end of 2018. At that time, the corporation has an accumulated adjustments account of \(\$ 2,500\). How would a distribution made during 2019...

-

Compare and contrast a circuit-switched network and a packet-switched network.

-

A retail product has the following standard costs established: Direct Material per unit - 2 pounds at $5 a pound Direct Labor per unit - 3 hours at $12 an hour Manufacturing Overhead - $5 per labor...

-

In a recent year, the Better Business Bureau settled 75% of complaints they received. (Source: USA Today, March 2, 2009) You have been hired by the Bureau to investigate complaints this year...

-

A 1200-ft equal tangent crest vertical curve is currently designed for 50 mph. A civil engineering student contends that 60 mph is safe in a van because of the higher driver's eye height. If all...

-

Required information [The following information applies to the questions displayed below.] Victory Company uses weighted-average process costing to account for its production costs. Conversion cost...

-

Finer, % 100 90 80 70 60 50 40 30 20 10 0 0.01 0.1 1 Size, mm L 10 100 Figure shows a grain size distribution curve of soil. Estimate the coefficient of curvature (Cc) of this soil.

-

It has been suggested that firms located in illiquid and segmented emerging markets could follow Novos proactive strategy to internationalize their own cost of capital. What are the preconditions...

-

Walker, Inc., is an all-equity firm. The cost of the company's equity is currently 11.4 percent and the risk-free.rate is 3.3 percent. The company is currently considering a project that will cost...

-

7 . 4 3 Buy - side vs . sell - side analysts' earnings forecasts. Refer to the Financial Analysts Journal ( July / August 2 0 0 8 ) study of earnings forecasts of buy - side and sell - side analysts,...

-

Bond P is a premium bond with a coupon of 8.6 percent , a YTM of 7.35 percent, and 15 years to maturity. Bond D is a discount bond with a coupon of 8.6 percent, a YTM of 10.35 percent, and also 15...

-

QUESTION 2 (25 MARKS) The draft financial statements of Sirius Bhd, Vega Bhd, Rigel Bhd and Capella for the year ended 31 December 2018 are as follows: Statement of Profit or Loss for the year ended...

Study smarter with the SolutionInn App