Joe Quick and Jane Reddy are equal partners in the Quick and Reddy partnership. On the first

Question:

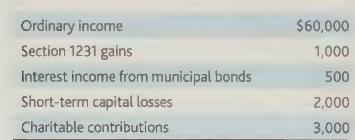

Joe Quick and Jane Reddy are equal partners in the Quick and Reddy partnership. On the first day of the current taxable year, Joe’s adjusted basis in his partnership interest is

$10,000 and Jane’s adjusted basis is $2,000.

During the year, Joe had withdrawals of

$25,000 and Jane had withdrawals of

$20,000. Given the following partnership activity for the year, determine each partner's adjusted basis in Quick and Reddy at the end of the taxable year.

Transcribed Image Text:

Ordinary income Section 1231 gains Interest income from municipal bonds Short-term capital losses Charitable contributions $60,000 1,000 500 2,000 3,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 0% (1 review)

Answer Lets calculate each partners adjusted basis in Quick and Reddy at the end of the taxable year ...View the full answer

Answered By

Aysha Ali

my name is ayesha ali. i have done my matriculation in science topics with a+ . then i got admission in the field of computer science and technology in punjab college, lahore. i have passed my final examination of college with a+ also. after that, i got admission in the biggest university of pakistan which is university of the punjab. i am studying business and information technology in my university. i always stand first in my class. i am very brilliant client. my experts always appreciate my work. my projects are very popular in my university because i always complete my work with extreme devotion. i have a great knowledge about all major science topics. science topics always remain my favorite topics. i am also a home expert. i teach many clients at my home ranging from pre-school level to university level. my clients always show excellent result. i am expert in writing essays, reports, speeches, researches and all type of projects. i also have a vast knowledge about business, marketing, cost accounting and finance. i am also expert in making presentations on powerpoint and microsoft word. if you need any sort of help in any topic, please dont hesitate to consult with me. i will provide you the best work at a very reasonable price. i am quality oriented and i have 5 year experience in the following field.

matriculation in science topics; inter in computer science; bachelors in business and information technology

_embed src=http://www.clocklink.com/clocks/0018-orange.swf?timezone=usa_albany& width=200 height=200 wmode=transparent type=application/x-shockwave-flash_

4.40+

11+ Reviews

14+ Question Solved

Related Book For

CCH Federal Taxation Basic Principles 2020

ISBN: 9780808051787

2020 Edition

Authors: Ephraim P. Smith, Philip J. Harmelink, James R. Hasselback

Question Posted:

Students also viewed these Business questions

-

Joe Quick and Jane Reddy are equal partners in the Quick and Reddy partnership. On the first day of the current taxable year, Joe's adjusted basis in his partnership interest is \(\$ 10,000\) and...

-

The ABC partnership has the following assets: I/S Basis FMV Cash 60,000 60,000 Accounts Receivable 0 30,000 Inventory 60,000 90,000 Land 30,000 90,000 As outside basis in the partnership is equal to...

-

The KA Patnership has two partners, K and A who are equal partners in the partnership. The partnership has a December 31, 2023 year- end and has completed its first year of business operations. Mr. K...

-

Which type of philosophical reasoning begins with one example and varies it to see how dramatic the change is, which uncovers its most crucial characteristics?

-

Determining the value of newly located natural gas sites involves estimating the gas composition, quantity, and ease of access. For example, one report described a find of 2 trillion cubic feet of...

-

What is the spring constant of a spring that stores 25 J of elastic potential energy when compressed by 7.5 cm?

-

What do you consider to be the benefits and drawbacks of shopping online for motor vehicles and other items?

-

In the past year, Oak Crafters Cabinets had total revenue of $2,500,000, cost of goods sold of $1,000,000 (before adjustment for over- or underapplied overhead), administrative expenses of $600,000,...

-

can i get answer in hour? it's about accounting i hope answer all of them or Please answer at least half of the questions. it's ok not answer all. If the liabilities of a company increased by $55,000...

-

Diane Barnes has a 25 percent interest and Ester Newton has a 75 percent interest in the income and capital of D&E Partnership. The partnership reports ordinary income of $25,000, tax-exempt interest...

-

Ina bona fide, arms-length transaction, a son, age 42, purchased from his father a 40 percent interest in the father's partnership, paying the full fair market value. The partnership is a...

-

In January 2019, inflation expectations in the United Kingdom fell from 2.9% to 2.6%. What effect will this have on inflation in the United Kingdom if nothing else changes in the economy? Explain...

-

In Exercises 25-28, construct a data set that has the given statistics. N = 8 2 3

-

Sample SAT scores for eight males and eight females are listed. Males 1010 1170 1410 920 1320 1100 690 1140 Females 1190 1010 1000 1300 1470 1250 840 1060

-

Best Actor 2018: Gary Oldman, Age: 59 Best Supporting Actor 2018: Sam Rockwell, Age: 49 The table shows population statistics for the ages of Best Actor and Best Supporting Actor winners at the...

-

Consider a market dominated by just two airlines, American and United. Each can choose to restrict capacity and charge a high price or expand capacity and charge a low price. If one of the two...

-

Using the product structure for Alpha in Solved Problem 14.1, and the following lead times, quantity on hand, and master production schedule, prepare a net MRP table for Alphas. Data From Problem...

-

President Bushs income tax cuts enacted in 2001 have come under increasing scrutiny due to the federal governments subsequent budget situation with an anticipated deficit for the next several years....

-

SCHEDULE OF COST OF GOODS MANUFACTURED The following information is supplied for Sanchez Welding and Manufacturing Company. Prepare a schedule of cost of goods manufactured for the year ended...

-

Anita has a one-half interest in the AB Partnership. Anitas basis in her interest at the beginning of the current year is $75,000. During the year, the following events occur: Partnership...

-

Keith has a one-half interest in the KL Partnership. His basis in the partnership interest at the end of the current year (before deducting his share of partnership losses) is $40,000. His share of...

-

Kevin has a 30% interest in the KLM Partnership. Louis (Kevins son) also has a 30% interest. An individual unrelated to either Kevin or Louis holds the remaining 40% interest. Kevin sells the...

-

Sociology

-

I am unsure how to answer question e as there are two variable changes. In each of the following, you are given two options with selected parameters. In each case, assume the risk-free rate is 6% and...

-

On January 1, Interworks paid a contractor to construct a new cell tower at a cost of $850,000. The tower had an estimated useful life of ten years and a salvage value of $100,000. Interworks...

Study smarter with the SolutionInn App