Jones, Able, and Smith want to form Shriver Corporation. They want to accomplish this in the most

Question:

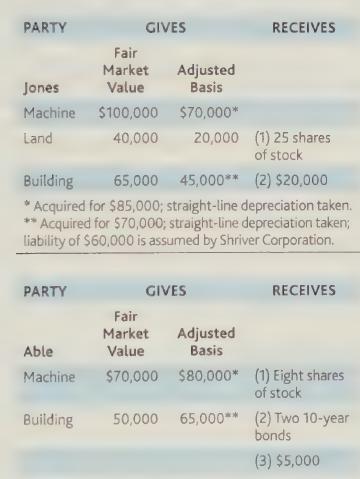

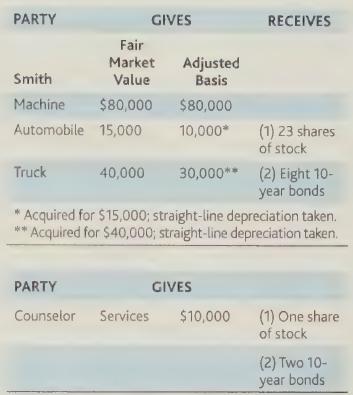

Jones, Able, and Smith want to form Shriver Corporation. They want to accomplish this in the most tax efficient

(least costly) way possible. They have asked for advice. The counselor will receive $10,000 (in stocks and bonds). The relevant information follows. Each bond has a face value of $2,500.

Determine all tax consequences for Jones, Able, Smith, the counselor, and Shriver Corporation assuming the transfer occurred in the current year. Also assume that Jones, Able, and Smith are unrelated parties.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

CCH Federal Taxation Basic Principles 2020

ISBN: 9780808051787

2020 Edition

Authors: Ephraim P. Smith, Philip J. Harmelink, James R. Hasselback

Question Posted: