A In its first year of business, Baumgartner Company purchased land, a building, and equipment on March

Question:

Instructions

(a) Allocate the purchase cost of the land, building, and equipment to each of the assets.

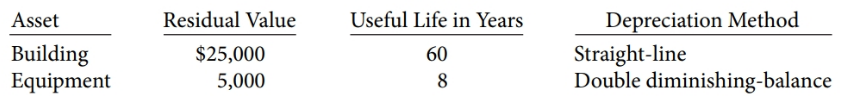

(b) Baumgartner Company has a December 31 fiscal year end and is trying to decide how to calculate depreciation for assets purchased during the year. Calculate depreciation expense for the building and equipment for 2013 and 2014 assuming:

1. Depreciation is calculated to the nearest whole month.

2. A half year€™s depreciation is recorded in the year of acquisition.

(c) Which policy should Baumgartner Company follow in the year of acquisition: recording depreciation to the nearest whole month or recording a half year of depreciation?

TAKING IT FURTHER

In the year the asset is purchased should Baumgartner Company record depreciation for the exact number of days the asset is owned? Why or why not?

Step by Step Answer:

Principles Of Financial Accounting

ISBN: 9781118757147

1st Canadian Edition

Authors: Jerry J. Weygandt, Michael J. Atkins, Donald E. Kieso, Paul D. Kimmel, Valerie Ann Kinnear, Barbara Trenholm, Joan E. Barlow