Juan divorced Maria in 2017. During 2019, per the divorce decree, Juan made the following payments: What

Question:

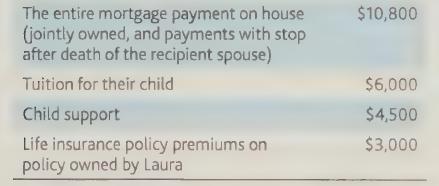

Juan divorced Maria in 2017. During 2019, per the divorce decree, Juan made the following payments:

What is the amount Juan can deduct as alimony on his 2019 tax return?

a. $3,000

b. $5,400

c. $8,400

d. $10,800

Transcribed Image Text:

The entire mortgage payment on house (jointly owned, and payments with stop after death of the recipient spouse) Tuition for their child Child support Life insurance policy premiums on policy owned by Laura $10,800 $6,000 $4,500 $3,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (1 review)

To qualify as deductible alimony on Juans tax return the payments must meet specific criteria outlin...View the full answer

Answered By

Anthony Ngatia

I have three academic degrees i.e bachelors degree in Education(English & Literature),bachelors degree in business administration(entrepreneurship option),and masters degree in business administration(strategic management) in addition to a diploma in business management.I have spent much of my life in the academia where I have taught at high school,middle level colleges level and at university level.I have been an active academic essays writer since 2011 where I have worked with some of the most reputable essay companies based in Europe and in the US.I have over the years perfected my academic writing skills as a result of tackling numerous different assignments.I do not plagiarize and I maintain competitive quality in all the assignments that I handle.I am driven by strong work ethics and a firm conviction that I should "Do Unto others as I would Like them to do to me".

4.80+

76+ Reviews

152+ Question Solved

Related Book For

CCH Federal Taxation Basic Principles 2020

ISBN: 9780808051787

2020 Edition

Authors: Ephraim P. Smith, Philip J. Harmelink, James R. Hasselback

Question Posted:

Students also viewed these Business questions

-

Your client, Jack Benny, and his wife were divorced last year. Jack had been employed by the city of Rancho Cucamonga for 30 years. Jack was a participant in a defined-benefit pension plan. He had...

-

The following additional information is available for the Dr. Ivan and Irene Incisor family from Chapters 1-5. Ivan's grandfather died and left a portfolio of municipal bonds. In 2012, they pay Ivan...

-

The following additional information is available for the Dr. Ivan and Irene Incisor family. The Incisors own a rental beach house in Hawaii. The beach house was rented for the full year during 2012...

-

Clapton Company's sales budget shows the following projections for the year ending December 31, 2017: Quarters First (Jan -March) Second (April June) Third (July-Sept) Fourth (Oct-Dec) Total First...

-

Contrast the roles of ER-bound ribosomes with those free in the cytosol.

-

hello, this is accounting theory practise. Explain TWO (2) methods used to disclose social and environmental information. (10 marks)

-

EXERCISE 27 Job-Order Costing; Working Backwards LO21, LO22, LO23 Hahn Company uses a job-order costing system. Its plantwide predetermined overhead rate uses direct labor-hours as the allocation...

-

City Taxi purchases a new taxi cab for $25,000. The cab has an estimated salvage value of $1,000 and is expected to be driven for approximately 120,000 miles over its useful life of five years....

-

Umstead Company provides the following information about its single product. What is the contribution margin per unit? A. $4.80 B. $1.80 C. $0.27 D. $11.40

-

Which of the following item(s) must be included in an individuals return as income? a. Compensation for services b. Prizes and awards c. Inheritance (a) and (b) d. All of the above.

-

Each oft he following would be one oft he requirements for a payment to be alimony under instruments executed after 1984, but before 2019, except: a. Payments are required by a divorce or separation...

-

The sales S (in thousands of units) of a seasonal product are given by the model where t is the time in months, with t = 1 corresponding to January. Find the average sales for each time period.(a)...

-

Begin by locating a scholarly article regarding the effects of increases on minimum wages and discuss its findings. Does a minimum wage increase lead to reductions in employment, or is the overall...

-

Pick an organization (or you can use an example that has professional relevance), and use the DAC framework to accomplish the following objectives. Provide background and a problem statement of the...

-

Woodruff Company is currently producing a snowmobile that uses five specialized parts. Engineering has proposed replacing these specialized parts with commodity parts, which will cost less and can be...

-

What was Newell's organizational culture like before acquiring Rubbermaid? What was the quadrant? Is the perspective short or long term, inside or outside focused, interested in people, process, or...

-

(7.47 of Koretsky 2nd edition) A binary mixture of species 1 and 2 can be described by the following equation of state: P = a 0 VoT The pure species coefficients are given by: amix y1a1a2Y2 with the...

-

What are the differences between proportionate and disproportionate stratified sampling?

-

Find a polar equation for the curve represented by the given Cartesian equation. 4y 2 = x

-

Collettes S corporation holds a small amount of accumulated earnings and profits (AEP), requiring the use of a more complex set of distribution rules. Collettes accountant tells her that this AEP...

-

For each of the following independent statements, indicate whether the transaction will increase (+), decrease (), or have no effect (NE) on the basis of a shareholders stock in an S corporation. a....

-

Sheila Jackson is a 50% shareholder in Washington, Inc., an S corporation. This year, Jacksons share of the Washington loss is $100,000. Jackson has income from several other sources. Identify at...

-

Show that the convexity for a zero coupon bond with m payments per year is (m) n(n + -)(1+ m m

-

Abdul Canarte , a Central Bank economist, noticed that the total group purchasing basket of goods (CPI) has gone from $149,740.00 to $344,460.00 in 8 years. With monthly compounding, what is the...

-

ABC Corporation expects sales next year to be $50,000,000. Inventory and accounts receivable (combined) will increase $8,000,000 to accommodate this sales level. The company has a profit margin of 6...

Study smarter with the SolutionInn App