Lyle Inc. is a cash-basis, calendar-year taxpayer. In 2018, it changes to the accrual method of accounting.

Question:

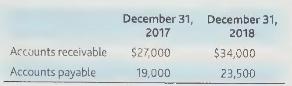

Lyle Inc. is a cash-basis, calendar-year taxpayer. In 2018, it changes to the accrual method of accounting. Its 2018 income computed under the accrual method is \(\$ 75,000\). The following information also is available:

What is Lyle's required adjustment to income for 2018 and how should Lyle report it?

What is Lyle's required adjustment to income for 2018 and how should Lyle report it?

Transcribed Image Text:

Accounts receivable Accounts payable December 31, December 31, 2017 2018 $27,000 19,000 $34,000 23,500

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 66% (3 reviews)

To compute the adjustment to income for 2018 due to the change from the cash basis to the accrual me...View the full answer

Answered By

Ashington Waweru

I am a lecturer, research writer and also a qualified financial analyst and accountant. I am qualified and articulate in many disciplines including English, Accounting, Finance, Quantitative spreadsheet analysis, Economics, and Statistics. I am an expert with sixteen years of experience in online industry-related work. I have a master's in business administration and a bachelor’s degree in education, accounting, and economics options.

I am a writer and proofreading expert with sixteen years of experience in online writing, proofreading, and text editing. I have vast knowledge and experience in writing techniques and styles such as APA, ASA, MLA, Chicago, Turabian, IEEE, and many others.

I am also an online blogger and research writer with sixteen years of writing and proofreading articles and reports. I have written many scripts and articles for blogs, and I also specialize in search engine

I have sixteen years of experience in Excel data entry, Excel data analysis, R-studio quantitative analysis, SPSS quantitative analysis, research writing, and proofreading articles and reports. I will deliver the highest quality online and offline Excel, R, SPSS, and other spreadsheet solutions within your operational deadlines. I have also compiled many original Excel quantitative and text spreadsheets which solve client’s problems in my research writing career.

I have extensive enterprise resource planning accounting, financial modeling, financial reporting, and company analysis: customer relationship management, enterprise resource planning, financial accounting projects, and corporate finance.

I am articulate in psychology, engineering, nursing, counseling, project management, accounting, finance, quantitative spreadsheet analysis, statistical and economic analysis, among many other industry fields and academic disciplines. I work to solve problems and provide accurate and credible solutions and research reports in all industries in the global economy.

I have taught and conducted masters and Ph.D. thesis research for specialists in Quantitative finance, Financial Accounting, Actuarial science, Macroeconomics, Microeconomics, Risk Management, Managerial Economics, Engineering Economics, Financial economics, Taxation and many other disciplines including water engineering, psychology, e-commerce, mechanical engineering, leadership and many others.

I have developed many courses on online websites like Teachable and Thinkific. I also developed an accounting reporting automation software project for Utafiti sacco located at ILRI Uthiru Kenya when I was working there in year 2001.

I am a mature, self-motivated worker who delivers high-quality, on-time reports which solve client’s problems accurately.

I have written many academic and professional industry research papers and tutored many clients from college to university undergraduate, master's and Ph.D. students, and corporate professionals. I anticipate your hiring me.

I know I will deliver the highest quality work you will find anywhere to award me your project work. Please note that I am looking for a long-term work relationship with you. I look forward to you delivering the best service to you.

3.00+

2+ Reviews

10+ Question Solved

Related Book For

CCH Federal Taxation 2019 Comprehensive Topics

ISBN: 9780808049081

2019 Edition

Authors: Ephraim P. Smith, Philip J. Harmelink, James R. Hasselback

Question Posted:

Students also viewed these Business questions

-

Bottle-Up, Inc. was organized on January 8, 2010. and made its Selection on January 24, 2010. The necessary consents to the election were filed in a timely manner. Its address is 1234 Hill Street,...

-

Cash flow from operating activities (CFO) indicates the amount of money a company brings in from its ongoing, regular business activities, such as manufacturing and selling goods or providing a...

-

Lyle Inc. is a cash-basis, calendar-year taxpayer. In 2019, it changes to the accrual method of accounting, Its 2019 income computed under the accrual method is $75,000. The following information...

-

You are the manager of an organization in America that distributes blood to hospitals in all 50 states and the District of Columbia. Arecent report indicates that nearly 50 Americans contract HIV...

-

Find the z-scores that separate the middle 94% of the distribution from the area in the tails of the standard normal distribution. Find the indicated z-score. Be sure to draw a standard normal curve...

-

Audit Committees. The city council members of Laurel City are considering establishing an audit committee as a subset of the council. Several members work for commercial businesses that have recently...

-

4 Suppose you introduced a new consumer food product and invested heavily both in national advertising (pull strategy) and in training and motivating your field salesforce to sell the product to food...

-

Diamond Software, Inc., does software development. One important activity in software development is writing software code. The manager of the Wordpro Development Team determined that the average...

-

Bonita Industries is issuing $9.9 million 16% bonds in a private placement on July 1, 2020. Each $1300 bond pays interest semi-annually on December 31 and June 30 of each year. The bonds mature in...

-

Wagner Co. is a cash-basis, calendar-year taxpayer. On August 1, 2018, it paid an insurance premium of \(\$ 4,800\) for coverage from August 1, 2018 to July 31, 2019. What is the largest deduction...

-

The Light Record Corporation has been on the calendar year since its inception five years ago. It wishes to change to an April 30 natural business year. For 2018, the calendar year of proposed...

-

The City Square Grocery and Meat Market has a large meat locker in which a constant temperature of approximately 4.5º C should be maintained. The market manager decides to construct an R-chart...

-

Q.9 Prepare a cash flow statement using the indirect method based on the following information: - Net Income: $150,000 - Depreciation Expense: $20,000 - Increase in Accounts Receivable: $10,000...

-

3.11 (a) Find the order of the elements 2, 7, 10 and 12 in F17. (b) Find the order of the elements a, a, a + 1 and a3 + 1 in F16, where a is a root of 1+x+x4.

-

You have been recently hired to lead a Project to relocate your main Distribution Centre (DC) from Calgary, Alberta to St. John's, Newfoundland. As the Project Manager, try to complete a project plan...

-

Males Mean: 69.6 Standard Deviation: 11.3 For males, find P90, which is the pulse rate separating the bottom 90% from the top 10%.

-

Statistics Assignments Using Excel Assignment #4: Measures of Variability Part I Below are ACT composite scores from 20 randomly selected college students. 15 33 20 25 21 24 17 16 20 25 26 21 21 17...

-

Does a down-and-out call become more valuable or less valuable as we increase the frequency with which we observe the asset price in determining whether the barrier has been crossed? What is the...

-

Separate variables and use partial fractions to solve the initial value problems in Problems 18. Use either the exact solution or a computer-generated slope field to sketch the graphs of several...

-

Smith Co. has no E&P, current or accumulated, prior to the following independent transactions with its sole shareholder, Chris: Distribution of LIFO inventory with a basis of $7,000, a FIFO value of...

-

Special Motors Inc. has E&P of $53,000. It distributes a building to the individual sole shareholder. The building has a basis of $17,000 and a value of $54,000, and is subject to a mortgage of...

-

Flash Co. distributed $40,000 to Skip Inc., a 25 percent shareholder. Flash Co.'s E&P applicable to Skip Inc.s distribution is $20,000 and Skip Inc. had a basis in its stock of $14,000. a. How much...

-

3. The nominal interest rate compounded monthly when your $7,000 becomes $11,700 in eight years is ________

-

An investor can design a risky portfolio based on two stocks, A and B. Stock A has an expected return of 21% and a standard deviation of return of 39%. Stock B has an expected return of 14% and a...

-

Advanced Small Business Certifica Drag and Drop the highlighted items into the correct boxes depending on whether they increase or decrease Alex's stock basis. Note your answers- you'll need them for...

Study smarter with the SolutionInn App