Sandy had the following items on her timely filed 2018 income tax return: Sandy inadvertently omitted some

Question:

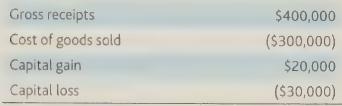

Sandy had the following items on her timely filed 2018 income tax return:

Sandy inadvertently omitted some income on her 2018 return. What is the statute of limitations if she omitted $100,000 of income on the return? re if she omitted $120,000 of income?

Transcribed Image Text:

Gross receipts Cost of goods sold Capital gain Capital loss $400,000 ($300,000) $20,000 ($30,000)

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (1 review)

ANSWER The statute of limitations for the IRS to assess additional taxes depends on the amount of in...View the full answer

Answered By

Jonas Araujo

I have recently received the degree of PhD. In Physics by the Universidade Federal do Maranhão after spending a term in Durham University, as I have been awarded a scholarship from a Brazilian mobility program. During my PhD. I have performed research mainly in Theoretical Physics and published works in distinguished Journals (check my ORCID: https://orcid.org/0000-0002-4324-1184).

During my BSc. I have been awarded a scholarship to study for a year in the University of Evansville, where I have worked in detection-analysis of photon correlations in the the Photonics Laboratory. There I was a tutor in Electromagnetism, Classical Mechanics and Calculus for most of that year (2012).

I am very dedicated, honest and a fast learner, but most of all, I value a job well done.

5.00+

1+ Reviews

10+ Question Solved

Related Book For

CCH Federal Taxation Basic Principles 2020

ISBN: 9780808051787

2020 Edition

Authors: Ephraim P. Smith, Philip J. Harmelink, James R. Hasselback

Question Posted:

Students also viewed these Business questions

-

Sandy inadvertently omitted some income on her 2014 return What is the statute of limitations if she omitted 100000 of income on the return What if she omitted 120000 of income

-

The Cypress Tool & Die Companys fiscal year ends on December 31. The company had the following items on its 20X1 income statement and balance sheet (in millions): Net sales and other operating...

-

The Crazy Eddie fraud may appear smaller and gentler than the massive billion-dollar frauds exposed in recent times, such as Bernie Madoffs Ponzi scheme, frauds in the subprime mortgage market, the...

-

Shauna immigrated to Canada in her 30s and has worked full time earning above YMPE throughout. Now she is a few years from retirement and has found out that her monthly OAS at age 65 will be $520....

-

What is the specific role of the menisci of the knee? Of the anterior and posterior cruciate ligaments?

-

Harry Chow, the owner of Chow Installation and Repair Ltd. (Chow) has come to you for advice, 87 DTC 5025 (F.C.A.) but first he describes his business. Chow is in the business of installing and...

-

(Appendix) Solve balance sheet only problems (for CPA exam issue). AppendixLO1

-

Eminence Corporation makes rocking chairs. The chairs move through two departments during production. Lumber is cut into chair parts in the cutting department, which transfers the parts to the...

-

1. In November of 2022 , in Edmonton, Alberta, Canada , the Canadian federal and provincial governments announced approximately $475 million (CAD) in project funding for Air Products'...

-

At February 15, 2017, Brent filed his 2016 income tax return (Due April 15, 2017), and he paid a tax of $15,000 at that time. on June 10, 2018, he filed an amended 2016 return showing an additional...

-

Tommy gives a painting to a church and takes a charitable contribution deduction in the amount of$ 50,000. If the actual value was only $20,000 and if the tax underpayment is $12,000, how much...

-

Defi ne cultural intelligence.

-

Obtain the phase trajectories for a system governed by the equation \[\ddot{x}+0.4 \dot{x}+0.8 x=0\] with the initial conditions \(x(0)=2\) and \(\dot{x}(0)=1\) using the method of isoclines.

-

Indicate whether each of the following accounts normally has a debit balance or a credit balance. a. Land b. Dividends c. Accounts Payable d. Unearned Revenue e. Consulting Revenue f. Salaries...

-

Indicate whether each of the following accounts normally has a debit or credit balance. a. Common Stock b. Retained Earnings c. Land d. Accounts Receivable e. Insurance Expense f. Cash g. Dividends...

-

Match each of the items in the left column with the LO5, 6 appropriate annual report component from the right column: 1. The company's total liabilities 2. The sources of cash during the period 3. An...

-

Allegra Company has sales of \($167,000\) and a bicak-even sales point of \($123,000\). Compute Allegra s margin of safety and its margin of safety ratio.

-

Explain why scale transformations are made.

-

Recall that Chapter 8 described the binary search algorithm for finding a particular entry in an ordered list. The idea behind binary search is to begin looking in the exact center of the list. If...

-

Harlan Huston had a net Section 1231 gain in 2018 of \(\$ 40,000\). His net Section 1231 gains and losses were as follows: How is the \(\$ 40,000\) net Section 1231 gain treated by Harlan in 2018?...

-

In 2017, Allen Appleton sells his business to David, but he sells the claim against Fred that arose during the course of his business to George, who is not in a business. The claim becomes worthless...

-

Mark Mullins had the following transactions or involuntary conversions during 2018: a. His diamond gemstones costing \(\$ 4,000\) in 2012 were sold for \(\$ 5,000\). b. His office building owned for...

-

Break-Even Sales and Sales to Realize Income from Operations For the current year ending October 31, Yentling Company expects fixed costs of $537,600, a unit variable cost of $50, and a unit selling...

-

You buy a stock for $35 per share. One year later you receive a dividend of $3.50 per share and sell the stock for $30 per share. What is your total rate of return on this investment? What is your...

-

Filippucci Company used a budgeted indirect-cost rate for its manufacturing operations, the amount allocated ($200,000) is different from the actual amount incurred ($225,000). Ending balances in the...

Study smarter with the SolutionInn App