Harlan Huston had a net Section 1231 gain in 2018 of ($ 40,000). His net Section 1231

Question:

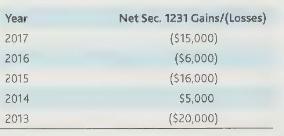

Harlan Huston had a net Section 1231 gain in 2018 of \(\$ 40,000\). His net Section 1231 gains and losses were as follows:

How is the \(\$ 40,000\) net Section 1231 gain treated by Harlan in 2018?

Transcribed Image Text:

Year 2017 2016 2015 2014 2013 Net Sec. 1231 Gains/(Losses) ($15,000) ($6,000) ($16,000) $5,000 ($20,000)

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 0% (3 reviews)

Section 1231 gains and losses refer to gains and losses on the sale or exchange of certain business ...View the full answer

Answered By

Akshay Agarwal

I am a Post-Graduate with a specialization in Finance. I have been working in the Consulting industry for the past 8 years with a focus on the Corporate and Investment Banking domain. Additionally, I have been involved in supporting student across the globe in their academic assignments and always strive to provide high quality support in a timely manner. My notable achievements in the academic field includes serving more than 10,000 clients across geographies on various courses including Accountancy, Finance, Management among other subjects. I always strive to serve my clients in the best possible way ensuring high quality and well explained solutions, which ensures high grades for the students along-with ensuring complete understanding of the subject matter for them. Further, I also believe in making myself available to the students for any follow-ups and ensures complete support and cooperation throughout the project cycle. My passion in the academic field coupled with my educational qualification and industry experience has proved to be instrumental in my success and has helped me stand out of the rest. Looking forward to have a fruitful experience and a cordial working relationship.

5.00+

179+ Reviews

294+ Question Solved

Related Book For

CCH Federal Taxation 2019 Comprehensive Topics

ISBN: 9780808049081

2019 Edition

Authors: Ephraim P. Smith, Philip J. Harmelink, James R. Hasselback

Question Posted:

Students also viewed these Business questions

-

Harlan Huston had a net Section 1231 gain in 2019 of $40,000. His net Section 1231 gains and losses were as follows: How is the $40,000 net Section 1231 gain treated by Harlan in 2019? Year 2018 2017...

-

How are net losses treated in the Section 1231 netting process? How is a net Section 1231 gain taxed?

-

Emily Jackson (Social Security number 765-12-4326) and James Stewart (Social Security number 466-74-9932) are partners in a partnership that owns and operates a barber shop. The partnership's first...

-

The JoFe Computers and Accessory Company produces two types of laptop computer bags. Version A costs $32, takes 4 hours of labor, and sells for $50. Version B costs $38, takes 6 hours of labor, and...

-

Find the z-score such that the area under the standard normal curve to its left is 0.1. Find the indicated z-score. Be sure to draw a standard normal curve that depicts the solution.

-

Distinguish between accountability and interperiod equity.

-

9 BMW recently introduced its first sports activity vehicle, the X6, to compete with other popular crossover vehicles such as the Mercedes-Benz GLE-Class. Design a direct marketing program to...

-

The Chen Corporation manufactures and sells two products: Thingone and Thingtwo. In July 2016, Chen's budget department gathered the following data to prepare budgets for 2017: 2017 Projected Sales...

-

11. For each of the following statements, indicate whether it is true, false, or uncertain. The Statement True (C), False (F) or Uncertain U) A cost is something used up to produce revenues in a...

-

Jason is single and uses the calendar year for his tax year. He died on May 15, 2018. When is his final income tax return due?

-

In 2017, Allen Appleton sells his business to David, but he sells the claim against Fred that arose during the course of his business to George, who is not in a business. The claim becomes worthless...

-

Discuss in your class group(s) some of the issues you have personally experienced when monitoring and controlling resources in a project you have worked on.

-

Prevosti Farms and Sugarhouse pays its employees according to their job classification. The following employees make up Sugarhouse's staff: Payroll Payroll Register Register Thomas Avery Towle...

-

Name: Course: Worksheet Lab Experience 5 Logic Circuits (A) Exercise 5.1 Truth table for the example circuit A B Output Value 0 0 1 1 0 1 1 Exercise 5.2 A slight change in the example circuit...

-

Stanley Medical Hospital is a non-profit and a non-chartered hospital planning to acquire several hospitals in the area. The hospital is researching financial options since they want to expand into...

-

Tony and Suzie see the need for a rugged all-terrain vehicle to transport participants and supplies. They decide to purchase a used Suburban on July 1, 2022, for $12,000. They expect to use the...

-

Pacifico Company, a US-based importer of beer and wine, purchased 1,800 cases of Oktoberfest-style beer from a German supplier for 522,000 euros. Relevant U.S. dollar exchange rates for the euro are...

-

Suppose that c 1 and p 1 are the prices of a European average price call and a European average price put with strike price K and maturity T, c 2 and p 2 are the prices of a European average strike...

-

Copy and complete the statement. 3800 m ? km =

-

Cambo Corporation, a calendar-year taxpayer, was formed in 2016 and incurred $60,000 in organizational expenditures. Had the corporation made a proper election under Code Sec. 248, it would have been...

-

Jones, Able, and Smith want to form Shriver Corporation. They want to accomplish this in the most tax efficient (least costly) way possible. They have asked for advice. The counselor will receive...

-

Mr. Trent transferred three apartment buildings to a new corporation in exchange for all its stock. The facts pertaining to the buildings were: a. What gains are realized and recognized on each...

-

Create a Data Table to depict the future value when you vary the interest rate and the investment amount. Use the following assumptions: Interest Rates: Investment Amounts:-10.0% $10,000.00 -8.0%...

-

Isaac earns a base salary of $1250 per month and a graduated commission of 0.4% on the first $100,000 of sales, and 0.5% on sales over $100,000. Last month, Isaac's gross salary was $2025. What were...

-

Calculate the price, including both GST and PST, that an individual will pay for a car sold for $26,995.00 in Manitoba. (Assume GST = 5% and PST = 8%) a$29,154.60 b$30,234.40 c$30,504.35 d$28,334.75...

Study smarter with the SolutionInn App