Scandinavian Furniture Inc., a calendar-year corporation, is worried about the accumulated earnings tax. In February, the following

Question:

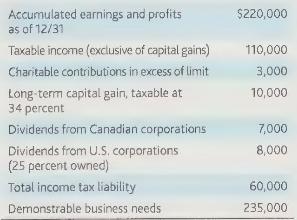

Scandinavian Furniture Inc., a calendar-year corporation, is worried about the accumulated earnings tax. In February, the following facts are available for the preceding year:

If the consent dividend route is to be used, which amount must be reported to avoid the accumulated earnings tax?

Transcribed Image Text:

Accumulated earnings and profits as of 12/31 Taxable income (exclusive of capital gains) Charitable contributions in excess of limit Long-term capital gain, taxable at 34 percent Dividends from Canadian corporations Dividends from U.S. corporations (25 percent owned) Total income tax liability Demonstrable business needs $220,000 110,000 3,000 10,000 7,000 8,000 60,000 235,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 66% (3 reviews)

ANSWER To determine the amount of dividends that must be reported to avoid the accumulated earnings ...View the full answer

Answered By

Utsab mitra

I have the expertise to deliver these subjects to college and higher-level students. The services would involve only solving assignments, homework help, and others.

I have experience in delivering these subjects for the last 6 years on a freelancing basis in different companies around the globe. I am CMA certified and CGMA UK. I have professional experience of 18 years in the industry involved in the manufacturing company and IT implementation experience of over 12 years.

I have delivered this help to students effortlessly, which is essential to give the students a good grade in their studies.

3.50+

2+ Reviews

10+ Question Solved

Related Book For

CCH Federal Taxation 2019 Comprehensive Topics

ISBN: 9780808049081

2019 Edition

Authors: Ephraim P. Smith, Philip J. Harmelink, James R. Hasselback

Question Posted:

Students also viewed these Business questions

-

Which form of business organization is limited by the Internal Revenue Code (IC) concerning the number and type of shareholders? A partnership An S corporation A C corporation A sole proprietorship...

-

Scandinavian Furniture Inc., a calendar-year corporation, is worried about the accumulated earnings tax. In February, the following facts are available for the preceding year: If the consent dividend...

-

Managing Scope Changes Case Study Scope changes on a project can occur regardless of how well the project is planned or executed. Scope changes can be the result of something that was omitted during...

-

North Folk Dairy has an unused bank revolving credit of $50 million. North Folk Dairys vendor provided an invoice in the amount of $100,000 with payment terms of 2/10, net 45. Compute the nominal...

-

With 20% of men, 74% of women, and 52% of children surviving the infamous Titanic disaster, it is clear that the saying "women and children first" was followed. But what, if any, role did the class...

-

A glass plate (n = 1.61) is covered with a thin, uniform layer of oil (n = 1.20). A light beam of variable wavelength is normally incident from air onto the oil surface. Observation of the reflected...

-

Soil Samples An environmental agency is analyzing soil samples from 50 farms for lead contamination. Eight of the farms have dangerously high levels of lead. If 10 farms are randomly selected from...

-

How, if at all, should MMC report the expected loss on the large receivable in its Form 10-K financial statements? Explain.

-

Use the following information for Shafer Company to compute inventory turnover for year 2 Net sales Cost of goods sold Ending inventory Year 2 $651,000 389,200 78,400 Year 1 $583,600 360,910 80,080

-

Marital Aids Inc. reported the following results last year: If the corporation has only four individual shareholders, compute the following: a. Adjusted ordinary gross income. b. Personal holding...

-

To arrive at adjusted ordinary gross income from gross income, the following subtractions are made, except: a. Rent and royalty expenses b. Section 1231 gains c. Ordinary and necessary business...

-

Jamalpur Dining manufactures tablecloths. Sales have grown rapidly over the past 2 years. As a result, the president has installed a budgetary control system for 2020. The following data were used in...

-

4. What is the time complexity of the following procedure for in/2 to n do j 2 end for while (j

-

If the concentration of a constituent in the influent to the equalization basin is constant over the 24 h period, will the load of the constituent from the basin be constant? If the concentration of...

-

A three-phase transmission line of a 60 Hz circuit has a length of 370 km (230 miles). the conductors are of the 795,000cm (54/7) type with horizontal spacing of 25 feet between them. The load on the...

-

Simulate rolling a dice using Math.random() . Your roll function should allow the caller to specify any number of sides, but default to 6 if no side count is given: roll() assumes a 6 sided dice,...

-

Drama Read the excerpt from a play. Then, answer the question(s). (1) (2) Belle: Having trouble deciding what will make you look like both a power to be reckoned with and a fetching young lady while...

-

A company has fixed production overhead costs totalling S20,000. The normal production level is 1,000 units per year, yielding a standard fixed overhead rate of $20 per unit. If the actual production...

-

What are the key elements of a system investigation report?

-

Richard and Sally Murphy were divorced in 2017. By the terms of their decree Richard pays Sally $1,000 a month for alimony and child support. When Jane, their 14-year-old daughter, reaches age 18,...

-

John and Mary Johnson were divorced in January 2018. By terms of their divorce decree John had to pay alimony to Mary at the rate of $50,000 in 2018, $25.000 in 2019, and zero in 2020. For the first...

-

Roy Rainer will pay his wife, Mae, alimony according to the following schedule: Roy and Mae were divorced on January 6, 2019. For the first three years of the agreement, what portions are excludable...

-

In 2019, Sunland Company had a break-even point of $388,000 based on a selling price of $5 per unit and fixed costs of $155,200. In 2020, the selling price and the variable costs per unit did not...

-

11. String Conversion Given a binary string consisting of characters '0's and '1', the following operation can be performed it: Choose two adjacent characters, and replace both the characters with...

-

Consider the table shown below to answer the question posed in part a. Parts b and c are independent of the given table. Callaway Golf (ELY) Alaska Air Group (ALK) Yum! Brands (YUM) Caterpillar...

Study smarter with the SolutionInn App