Tiller Corporation's net income per books (after taxes) was ($ 68,450). During the year, it had the

Question:

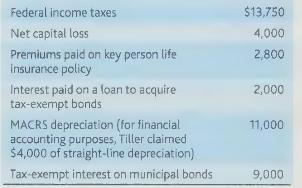

Tiller Corporation's net income per books (after taxes) was \(\$ 68,450\). During the year, it had the following transactions:

Determine Tiller Corporation's taxable income assuming it does not have an NOL deduction or special deductions. Reconcile the difference between book income and taxable income.

Transcribed Image Text:

Federal income taxes Net capital loss Premiums paid on key person life Insurance policy Interest paid on a loan to acquire tax-exempt bonds MACRS depreciation (for financial accounting purposes, Tiller claimed $4,000 of straight-line depreciation) Tax-exempt interest on municipal bonds $13,750 4,000 2,800 2,000 11,000 9,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 33% (3 reviews)

To determine Tiller Corporations taxable income we need to adjust the net income per books by adding or subtracting items that affect taxable income b...View the full answer

Answered By

Shubhradeep Maity

I am an experienced and talented freelance writer passionate about creating high-quality content. I have over five years of experience working in the field and have collaborated with several renowned companies and clients in the SaaS industry.

At Herman LLC, an online collective of writers, I generated 1,000+ views on my content and created journal content for 100+ clients on finance topics. My efforts led to a 60% increase in customer engagement for finance clients through revamping website pages and email interaction.

Previously, at Gerhold, a data management platform using blockchain, I wrote and published over 50 articles on topics such as Business Finance, Scalability, and Financial Security. I managed four writing projects concurrently and increased the average salary per page from $4 to $7 in three months.

In my previous role at Bernier, I created content for 40+ clients within the finance industry, increasing sales by up to 40%.

I am an accomplished writer with a track record of delivering high-quality content on time and within budget. I am dedicated to helping my clients achieve their goals and providing exceptional results.

5.00+

1+ Reviews

10+ Question Solved

Related Book For

CCH Federal Taxation 2019 Comprehensive Topics

ISBN: 9780808049081

2019 Edition

Authors: Ephraim P. Smith, Philip J. Harmelink, James R. Hasselback

Question Posted:

Students also viewed these Business questions

-

Tiller Corporations net income per books (after taxes) was $68,450. During the year, it had the following transactions: Determine Tiller Corporation's taxable income assuming it does not have an NOL...

-

The following additional information is available for the Dr. Ivan and Irene Incisor family from Chapters 1-5. Ivan's grandfather died and left a portfolio of municipal bonds. In 2012, they pay Ivan...

-

You, CPA, are the tax partner in your own small accounting firm, You CPA LLP. You have just finished a meeting with two potential clients; Adnan and Hae-Min Ranger. Adnan and Hae-Min are members at...

-

The Carter Caterer Company must have the following number of clean napkins available at the beginning of each of the next four days: day 1, 1500; day 2, 1200; day 3, 1800; day 4, 600. After being...

-

The following data represent the repair cost for a low-impact collision in a simple random sample of mini- and micro-vehicles (such as the Chevrolet Aveo or Mini Cooper). In Problem 33 from Section...

-

The wall of a liquid-to-gas heat exchanger has a surface area on the liquid side of 1.8 m2 (0.6m 3m) with a heat transfer coefficient of 255 W/(m2 K). On the other side of the heat exchanger wall...

-

What important criteria should be used to determine whether a sponsor can help the organization through the planned change? AppendixLO1

-

Bern Fly Rod Company is a small manufacturer of high- quality graphite fly-fishing rods. It sells its products to fly-fishing shops throughout the United States and Canada. Bern began as a small...

-

Kingbird Comparyy manogement wants to maintain a minimum monthly cash balance of $18,900. At the beginning of April, the cash balance is $20,900, expected cash receipts for April are $246,000, and...

-

Crates Corporation's financial income before income taxes for the year was \(\$ 250,000\). Organization costs of \(\$ 90,000\) are being written off over a 10-year period for financial statement...

-

The matrix below shows the stock ownership in four corporations by four unrelated individuals: Which of the above corporations, if any, are members of a brother-sister controlled group? Explain why...

-

P15-A3 The purpose of this problem is to show the relationship between the future value of 1 and the present value of 1. 1. Jan Schmidt will need $10.000 at the end of ten years in order to cover a...

-

Low Desert Pottery works makes a variety of pottery products that it sells to retailers. The company uses a job-order costing system in which departmental predetermined overhead rates are used to...

-

ASSESSMENT CPCCBC5002A Monitor costing systems on medium rise building and construction projects Please provide answer to Part 2 - Monitor expenditure for a medium-rise project as per below...

-

Questions 6-8 refer to the same problem A sinusoidal wave with wavelength 2 m and amplitude 5 mm is traveling along the x axis. The wave is traveling in the -x direction at a speed of 2m/s At t = Os,...

-

Consider a circuit where one or more capacitors is discharged through a light bulb filament with a resistance of 3.0 0.3 . Assume that the resistance of the filament is constant (to within the stated...

-

3. For a vibrating string of length with fixed ends, each mode of vibration can be written as where wk ux(x, t) = M* sin(wxt + k) sin(x) and Mk, Ok are determined by initial conditions. For all k >...

-

This case does not present a challenge, but rather focuses on the positive impact that a company can make on its community. This is important and distinctive within the industry because many people...

-

Calculate the electrical conductivity of a fiber-reinforced polyethylene part that is reinforced with 20 vol % of continuous, aligned nickel fibers.

-

Alpha Corporation began business at the beginning of the year. On February 15, George sold his stock to Danny. Alpha files for S corporation status on March 10, but George refuses to consent to the...

-

Damion Corporation begins its first tax year on June 23, 2019. What is the latest date that Damion may apply for S corporation status to qualify as of the beginning of operations?

-

Why is the S corporation preferred over regular corporation status in the early years of operation?

-

Summarize in your own words Sharps, Treynors, and Jensens Measures for assessing portfolio performance with respect to risk. Assess the portfolio performance of mutual fund VDIGX taking into...

-

Question 1 Slat and Company have recently set up a business which will manufacture and sell a furniture component, the F12 On the 19 August 2021, the company issued 85,000 of share capital for cash....

-

The following is Addison Corporations contribution format income statements for last month. The company has no beginning or ending inventories. A total of 10,000 units were produced and sold last...

Study smarter with the SolutionInn App