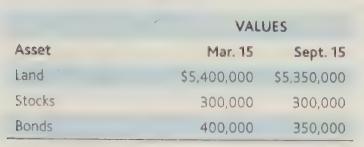

Tom Parks died on March 15, 2019. The values of Tom's assets on March 15 and September

Question:

Tom Parks died on March 15, 2019. The values of Tom's assets on March 15 and September 15, 2019, are as indicated below:

The marginal federal estate tax bracket applicable to Tom’s estate is 40 percent for property over $11.40 million. All of Tom’s property, which consists of the above capital assets, will go to his children, Ted and Jason.

Neither Ted nor Jason is a dealer in real estate. Should the executor elect alternate valuation under Code Sec. 2032? In deciding whether to elect the alternate valuation date, calculate both the estate tax consequences and the income tax consequences for the parties involved.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

CCH Federal Taxation Basic Principles 2020

ISBN: 9780808051787

2020 Edition

Authors: Ephraim P. Smith, Philip J. Harmelink, James R. Hasselback

Question Posted: