Which of the following trade or business expenditures of Ajax Inc. are deductible on its current year

Question:

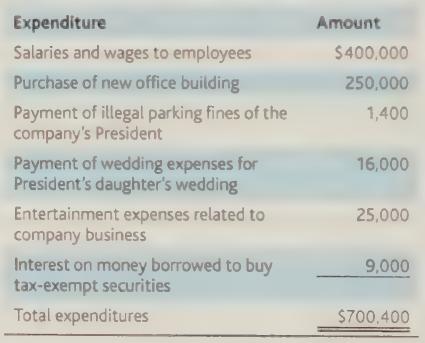

Which of the following trade or business expenditures of Ajax Inc. are deductible on its current year tax return? If an expenditure is not deductible, explain why it is not a valid deduction.

Transcribed Image Text:

Expenditure Salaries and wages to employees Purchase of new office building Payment of illegal parking fines of the company's President Payment of wedding expenses for President's daughter's wedding Entertainment expenses related to company business Interest on money borrowed to buy tax-exempt securities Total expenditures Amount $400,000 250,000 1,400 16,000 25,000 9,000 $700,400

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 33% (3 reviews)

Lets analyze each expenditure to determine whether it is deductible on Ajax Incs current year tax return Salaries and wages to employees Deductible Sa...View the full answer

Answered By

Muhammad Umair

I have done job as Embedded System Engineer for just four months but after it i have decided to open my own lab and to work on projects that i can launch my own product in market. I work on different softwares like Proteus, Mikroc to program Embedded Systems. My basic work is on Embedded Systems. I have skills in Autocad, Proteus, C++, C programming and i love to share these skills to other to enhance my knowledge too.

3.50+

1+ Reviews

10+ Question Solved

Related Book For

CCH Federal Taxation Basic Principles 2020

ISBN: 9780808051787

2020 Edition

Authors: Ephraim P. Smith, Philip J. Harmelink, James R. Hasselback

Question Posted:

Students also viewed these Business questions

-

Which of the following trade or business expenditures of Ajax Inc. are deductible on its current year tax return? If an expenditure is not deductible, explain why it is not a valid deduction....

-

Which of the following trade or business expenditures of Ajax Inc. are deductible on its current year tax return? If an expenditure is not deductible, explain why it is not a valid deduction....

-

1. Hannah is applying for a life policy on her girlfriend Sarahs life. The policy is $500,000 and carries a large premium. Hannah is the main earner, so she is concerned about not being able to pay...

-

Olmsted Co. has small computer chips assembled in Poland and transports the final assembled products to the parent, where they are sold by the parent in the U.S. The assembled products are invoiced...

-

Cominsky Company purchased a machine on July 1, 2015, for $28,000. Cominsky paid $200 in title fees and county property tax of $125 on the machine. In addition, Cominsky paid $500 shipping charges...

-

Required information Use the following information for the Exercises below. (Algo) [The following information applies to the questions displayed below.] NewTech purchases computer equipment for...

-

Thickness of dust on solar cells. The performance of a solar cell can deteriorate when atmospheric dust accumulates on the solar panel surface. In the International Journal of Energy and...

-

Data for the seven operating segments of Amalgamated Products follow: Included in the $105,000 revenue of the Bicycles segment are sales of $25,000 made to the Sporting Goods segment. Required a....

-

Chip 'n Dale Ltd is a successful advertising business. It has regularly met shareholder expectations by paying regular dividends. The board of directors' policy requires that for a dividend to be...

-

Are any of the following expenditures deductible on an individual taxpayer's income tax return? Explain each item. Expenditure Cost of having income tax return prepared by a CPA Legal fee for divorce...

-

Indicate whether the following expenditures are trade or business deductions (T), production of income deductions (PI), personal deductions (P), or are not deductible (X). Also indicate if the...

-

The two 12-kg slender rods are pin connected and released from rest at the position = 60. If the spring has an unstretched length of 1.5 m, determine the angular velocity of rod BC, when the system...

-

Exercise 11-5 Profit allocation in a partnership LO3Dallas and Weiss formed a partnership to manage rental properties, by investing $161,000 and $189,000, respectively. During its first year, the...

-

operation research an introduction by Taha, Hamdy A . 2 0 2 2 . Operations Research - An Introduction. 1 1 th ed . Prentice Hall..kindly explain this

-

which 2 statements are correct regarding budgets in quickbooks online? a . budgets can be created to track capital expenditures. b . budgets can be set up bsed on the last fiscal year's financial...

-

Dr. Yong has requested that Senture Houston, an office manager at Pain Free Dental Associates, prepare a single journal entry for December 31, 2022. The bank statement for that day shows $9,500....

-

This program will not require any IF statements, loops, or custom classes. Instead, it will check inputted data for two kinds of mistakes: Wrong data type (entering text instead of numbers), and math...

-

Discuss three ethical issues in marketing research that relate to (I) the client, (2) the supplier, and (3) the respondent.

-

l ask this second time correnct answer is 38,01 can we look pls Consider a non-conducting rod of length 8.8 m having a uniform charge density 4.5 nC/m. Find the electric potential at P, a...

-

Promotion has been the target of considerable criticism. What specific types of promotion are probably the object of this criticism? Give a particular example that illustrates your thinking.

-

With direct-response promotion, customers provide feedback to marketing communications. How can a marketing manager use this feedback to improve the effectiveness of the overall promotion blend?

-

How can a promotion manager aim a message at a certain target market with electronic media (like the Internet) when the customer initiates the communication? Give an example.

-

You have just been hired as a new management trainee by Earrings Unlimited, a distributor of earrings to various retail outlets located in shopping malls across the country. In the past, the company...

-

Brief Exercise 10-6 Flint Inc. purchased land, building, and equipment from Laguna Corporation for a cash payment of $327,600. The estimated fair values of the assets are land $62,400, building...

-

"faithful respresentation" is the overriding principle that should be followed in ones prepaparation of IFRS-based financial statement. what is it? explain it fully quoting IAS. how this this...

Study smarter with the SolutionInn App