Jorge has investments in two limited partnerships, both of which constitute passive activities. This year, Jorges distributive

Question:

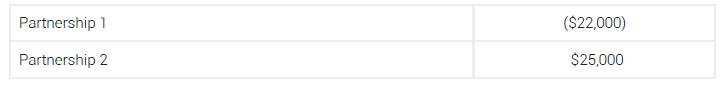

Jorge has investments in two limited partnerships, both of which constitute passive activities. This year, Jorge’s distributive share of income or loss from each partnership is as follows:

In addition to the current year income or loss, Jorge has a passive loss carryforward from prior years of ($10,000). How much of the passive loss carryforward can Jorge deduct on his current year tax return?

a. $10,000.

b. $3,000.

c. $0.

d. $7,000.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Taxation Essentials Of LLCs And Partnerships

ISBN: 9781119722328

1st Edition

Authors: Larry Tunnell, Robert Ricketts

Question Posted: