Joy died on November 5, 2020. Soon after Joys death, the executor discovered the following insurance policies

Question:

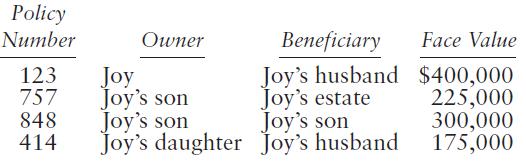

Joy died on November 5, 2020. Soon after Joy’s death, the executor discovered the following insurance policies on Joy’s life.

Joy transferred ownership of policies 757 and 848 to her son in 2010. She gave ownership of policy 414 to her daughter in 2018. Indicate the amount includible in Joy’s gross estate for each policy, without any consideration to the marital deduction.

Transcribed Image Text:

Policy Number Owner Beneficiary Face Value 123 757 848 414 Joy Joy's son Joy's son Joy's daughter Joy's husband Joy's husband $400,000 Joy's estate Joy's son 225,000 300,000 175,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 50% (16 reviews)

Policy Number Amount included ignoring any marital deduct...View the full answer

Answered By

Sufiyan Ahmed Tariq

I am a Chartered Accountant and an Associate Public & Finance Accountant. I also hold a bachelors of Commerce degree. I have over 8 years of experience in accounting, finance and auditing. Through out my career, I have worked with many leading multinational organisation.

I have helped a number of students in studies by teaching them key concepts of subjects like accounting, finance, corporate law and auditing. I help students understanding the complex situation by providing them daily life examples.

I can help you in the following subject / areas:

a) Accounting;

b) Finance;

c) Commerce;

d) Auditing; and

e) Corporate Law.

4.90+

7+ Reviews

17+ Question Solved

Related Book For

Federal Taxation 2021 Corporations, Partnerships, Estates & Trusts

ISBN: 9780135919460

34th Edition

Authors: Timothy J. Rupert, Kenneth E. Anderson, David S. Hulse

Question Posted:

Students also viewed these Business questions

-

Joy died on November 5, 2017. Soon after Joys death, the executor discovered the following insurance policies on Joys life. Joy transferred ownership of policies 757 and 848 to her son in 2009. She...

-

Joy died on November 5, 2015. Soon after Joys death, the executor discovered the following insurance policies on Joys life. Joy transferred ownership of policies 757 and 848 to her son in 2009. She...

-

Joy died on November 5, 2016. Soon after Joy's death, the executor discovered the following insurance policies on Joy's life. Joy transferred ownership of policies 757 and 848 to her son in 2009. She...

-

International Accounting Standard No. 21, "The Effects of Changes in Foreign Exchange Rates," deals with foreign currency. It was originally issued in 1983 and was revised and reissued in 1993 as...

-

After collecting IQ scores from hundreds of subjects, a box plot is constructed with this five-number summary: 82, 91, 100, 109, 118. If one of the subjects is randomly selected, find the probability...

-

ThefollowingquestionsarebasedonN ationalHealthExpenditureProjections, 2 017-2026:DespiteUncertainty,FundamentalsPrimarilyDrive S pendingGrowth(...

-

5. Ker and Pat are partners with capital balances of $60,000 and $20,000, respectively. Profits and losses are divided in the ratio of 60:40. Ker and Pat decide to admit Gra, who invested land with a...

-

Pams Creations had the following sales and purchase transactions during Year 2. Beginning inventory consisted of 60 items at $350 each. The company uses the FIFO cost flow assumption and keeps...

-

Save photo to enlarge image. Thanks! 23. What amount of Solar's Bonds Payable would appear on the consolidated balance sheet at December 31, 2019? Select one: A. $2,050,000 B. $2,010,000 C....

-

1. Assuming that you are SVP supply chain at a leading merchandiser of fashion apparel, what do you feel would be the benefits and drawbacks of developing a business relationship with Trans-Global...

-

The data types returned by the getScreenResolution() and getScreenSize() methods are ______________. a. Both ints b. An int and an object of type Dimension c. Both objects of type Dimension d. Both...

-

A Graphics2D object can be produced by ______________. a. Calling setGraphics2D() b. Calling getGraphics2D() c. Casting a Graphics2D object d. Casting a Graphics object

-

Which of the following are correct? (A) (i), (ii) and (iii) only (B) (ii), (iii) and (iv) only (C) (i), (ii) and (iv) only (D) (i) and (iv) only (i) Bought office furniture for cash (ii) A debtor, P...

-

FA II: Assignment 1 - COGS & Bank Reconciliation 1. The following data pertains to Home Office Company for the year ended December 31, 2020: Sales (25% were cash sales) during the year Cost of goods...

-

Bramble Stores accepts both its own and national credit cards. During the year, the following selected summary transactions occurred. Jan. 15 20 Feb. 10 15 Made Bramble credit card sales totaling...

-

11. Korina Company manufactures products S and T from a joint process. The sales value at split-off was P50000 for 6,000 units of Product S and P25,000 for 2,000 units of Product T. Assuming that the...

-

Karak Company produces Product (A) for only domestic distribution since year 2017. In 2019, a similar product to Karak Company has come onto the market by another competitor. Karak Company is keen to...

-

1. Purchase equipment in exchange for cash of $20,400. 2. Provide services to customers and receive cash of $4,900. 3. Pay the current month's rent of $1,000. 4. Purchase office supplies on account...

-

An auto dealer has 4 cars, 2 trucks, and 3 SUVs that it plans to display in a line across the front of the dealership. (a) In how many orders can these vehicles be displayed? (b) If the cars are...

-

Differentiate the following terms/concepts: a. Personality types and money attitudes b. Planners and avoiders c. Moderating and adapting to biases d. "Perfectible judges" and "incorrigible judges"

-

Holbrook, a calendar year S corporation, distributes $15,000 cash to its only shareholder, Cody, on December 31. Codys basis in his stock is $20,000, Holbrooks AAA balance is $8,000, and Holbrook...

-

Vogel, Inc., an S corporation for five years, distributes a tract of land held as an investment to Jamari, its majority shareholder. The land was purchased for $45,000 ten years ago and is currently...

-

Jonas is a 60% owner of Ard, an S corporation. At the beginning of the year, his stock basis is zero. Jonass basis in a $20,000 loan made to Ard and evidenced by Ards note has been reduced to $0 by...

-

Ted and his partners have contracted to purchase the franchise nights worth 561 000 to open and operate a specialty pizza restaurant called Popper with a renewable agrement, the partners have agreed...

-

Your answer is partially correct. Martin Company's chief financial officer feels that it is important to have data for the entire quarter especially since their financial forecasts indicate some...

-

Kellog Corporation is considering a capital budgeting project that would have a useful life of 4 years and would love testing 5156.000 in equipment that would have zeto salvage value at the end of...

Study smarter with the SolutionInn App