Sec. 338 Basis Allocation. Alpha Corporation purchases all of Theta Corporations stock for $300,000 cash. Alpha makes

Question:

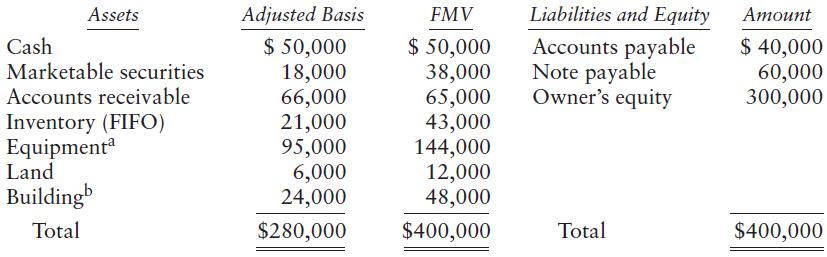

Sec. 338 Basis Allocation. Alpha Corporation purchases all of Theta Corporation’s stock for $300,000 cash. Alpha makes a timely Sec. 338 election. Theta’s balance sheet at the close of business on the acquisition date is as follows:

aThe equipment cost $200,000.

bThe building is MACRS property on which Theta has claimed $10,000 of depreciation.

a. What is the aggregate deemed sale price for the Theta assets (assume a 21% corporate tax rate)?

b. What amount and character of gain or loss must Theta recognize on the deemed sale?

c. What is the adjusted grossed-up basis for the Theta stock? What basis is allocated to each of the individual assets?

d. What happens to “old” Theta’s tax attributes? Do they carry over to “new” Theta?

e. What amount (if any) of goodwill can Theta amortize following the acquisition? Over what period and under what method may Theta amortize the goodwill?

Step by Step Answer:

Federal Taxation 2021 Corporations, Partnerships, Estates & Trusts

ISBN: 9780135919460

34th Edition

Authors: Timothy J. Rupert, Kenneth E. Anderson, David S. Hulse