Elaine died on May 1, 2022. Her gross estate consisted of the following items: Elaines Sec. 2053

Question:

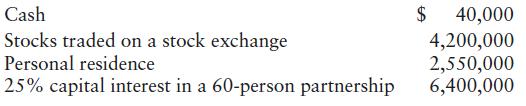

Elaine died on May 1, 2022. Her gross estate consisted of the following items:

Elaine’s Sec. 2053 deductions totaled $200,000. She had no other deductions.

a. What percentage of Elaine’s federal estate taxes can be paid in installments under Sec. 6166? When is the first installment payment due?

b. Could Elaine’s estate elect Sec. 6166 treatment if the stocks were valued at $10.2 million instead of $4.2 million?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Pearsons Federal Taxation 2023 Comprehensive

ISBN: 9780137840656

36th Edition

Authors: Timothy J. Rupert, Kenneth E. Anderson, David S Hulse

Question Posted: