In 2021, Mark purchased two separate activities. Information regarding these activities for 2021 and 2022 is as

Question:

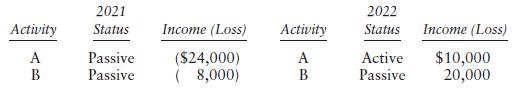

In 2021, Mark purchased two separate activities. Information regarding these activities for 2021 and 2022 is as follows:

The 2021 losses were suspended losses for that year. During 2022, Mark also reports salary income of $120,000 and interest and dividend income of $20,000. Compute the amount (if any) of losses attributable to Activities A and B that are deductible in 2022 and any suspended losses carried to 2023.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Pearsons Federal Taxation 2023 Comprehensive

ISBN: 9780137840656

36th Edition

Authors: Timothy J. Rupert, Kenneth E. Anderson, David S Hulse

Question Posted: