In 2022, Henry and his wife, Wendy, made the gifts shown below. All gifts are of present

Question:

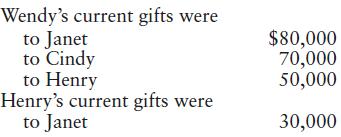

In 2022, Henry and his wife, Wendy, made the gifts shown below. All gifts are of present interests. What is Wendy’s gift tax payable for 2022 if the couple elects gift splitting and Wendy’s previous taxable gifts (made in 1955) total $1 million?

Transcribed Image Text:

Wendy's current gifts were to Janet to Cindy to Henry Henry's current gifts were to Janet $80,000 70,000 50,000 30,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 75% (8 reviews)

The gift tax is zero calculated as follows 192800 is the tax on the 600000 exemption eq...View the full answer

Answered By

Akshay Singla

as a qualified engineering expert i am able to offer you my extensive knowledge with real solutions in regards to planning and practices in this field. i am able to assist you from the beginning of your projects, quizzes, exams, reports, etc. i provide detailed and accurate solutions.

i have solved many difficult problems and their results are extremely good and satisfactory.

i am an expert who can provide assistance in task of all topics from basic level to advance research level. i am working as a part time lecturer at university level in renowned institute. i usually design the coursework in my specified topics. i have an experience of more than 5 years in research.

i have been awarded with the state awards in doing research in the fields of science and technology.

recently i have built the prototype of a plane which is carefully made after analyzing all the laws and principles involved in flying and its function.

1. bachelor of technology in mechanical engineering from indian institute of technology (iit)

2. award of excellence in completing course in autocad, engineering drawing, report writing, etc

4.70+

48+ Reviews

56+ Question Solved

Related Book For

Pearsons Federal Taxation 2023 Comprehensive

ISBN: 9780137840656

36th Edition

Authors: Timothy J. Rupert, Kenneth E. Anderson, David S Hulse

Question Posted:

Students also viewed these Business questions

-

In 2019, Henry and his wife, Wendy, made the gifts shown below. All gifts are of present interests. What is Wendy's gift tax payable for 2019 if the couple elects gift splitting and Wendy's previous...

-

In 2014, Henry and his wife, Wendy, made the gifts shown below. All gifts are of present interests. What is Wendy's gift tax payable for 2014 if the couple elects gift splitting and Wendy's previous...

-

In 2015, Henry and his wife, Wendy, made the gifts shown below. All gifts are of present interests. What is Wendys gift tax payable for 2015 if the couple elects gift splitting and Wendys previous...

-

A production supervisor at a major chemical company wishes to determine whether a new catalyst, catalyst XA-100, increases the mean hourly yield of a chemical process beyond the current mean hourly...

-

When you open your eyes underwater, everything is blurry. However, when you wear goggles, you can see clearly. Explain.

-

Assume that a friend of yours contends that the system model is obviously best to use with all employees, or it wouldnt have been placed on the right side of the figure. How would you respond? lop4

-

12-8. What is the principal difference between a marketing channel and a supply chain?

-

Connor Chemical Company's plant processes batches of organic chemical products through three stages after starting with raw materials: (1) Mixing and blending, (2) Reaction chamber, and (3)...

-

A company had the following purchases and sales during its first year of operations: Purchases Sales January: 10 units at $120 6 units February: 20 units at $125 5 units May: 15 units at $130 9 units...

-

a. Each of the following figures shows a person (not to scale) located on Earth at either 40?N or 40?S latitude Rank the figures based on how much time the person spends in day period. from most to...

-

During 2022, Will gives $40,000 cash to Will, Jr. nd a remainder interest in a few acres of land to his friend Suzy. The remainder interest is valued at $32,000. Will and his wife, Helen, elect gift...

-

In March 2022, Marge (age 67) engages in the following transactions. Determine the amount of the completed gift, if any, arising from each of the following events. Assume 4% is the applicable...

-

Why do people want to meet others on-line instead of finding them in the real world?

-

Give an example of a program that will cause a branch penalty in the three-segment pipeline of Sec. 9-5. Example: Three-Segment Instruction Pipeline A typical set of instructions for a RISC processor...

-

Are Google, Microsoft, and Apple acting ethically? Are they being socially responsible? Eager to benefit from the economic growth and the job creation that foreign direct investments generate, many...

-

On May 1, 2011, Lenny's Sandwich Shop loaned \$20,000 to Joe Lopez for one year at 6 percent interest. Required Answer the following questions: a. What is Lenny's interest income for 2011? b. What is...

-

Tipton Corporations balance sheet indicates that the company has \($300,000\) invested in operating as sets. During 2006, Tipton earned operating income of \($45,000\) on \($600,000\) of sales....

-

Norton Car Wash Co. is considering the purchase of a new facility. It would allow Norton to increase its net income by \($90,000\) per year. Other information about this proposed project follows:...

-

Light of wavelength 600 nm in vacuum enters a block of glass where n g = 1.5. Compute its wavelength in the glass.What color would it appear to someone embedded in the glass (see Table 3.4)? Table...

-

In your audit of Garza Company, you find that a physical inventory on December 31, 2012, showed merchandise with a cost of $441,000 was on hand at that date. You also discover the following items...

-

Contrast organizational culture and job satisfaction.

-

Identify the functional and dysfunctional effects of organizational culture on employees.

-

List the factors that maintain an organization's culture.

-

En prenant un exemple de votre choix, montrer comment on value un swap de taux de change.

-

How much would you need to invest today in order to receive: a. $10,000 in 5 years at 11%? b. $11,000 in 12 years at 8%? c. $12,000 each year for 10 years at 8%? d. $12,000 at the beginning of each...

-

A company that manufactures pulse Doppler insertion flow meters uses the Straight Line method for book depreciation purposes. Newly acquired equipment has a first cost of $190,000 with a 3-year life...

Study smarter with the SolutionInn App