Refer to the facts of Problem C:12-36 and assume the current year is 2022. Emilys prior gifts

Question:

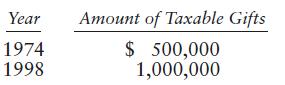

Refer to the facts of Problem C:12-36 and assume the current year is 2022. Emily’s prior gifts are as follows:

What is Emily’s current year gift tax liability?

Transcribed Image Text:

Year 1974 1998 Amount of Taxable Gifts $ 500,000 1,000,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 72% (11 reviews)

After the credit no tax is owed Emilys current gifts from Problem C123...View the full answer

Answered By

Pushpinder Singh

Currently, I am PhD scholar with Indian Statistical problem, working in applied statistics and real life data problems. I have done several projects in Statistics especially Time Series data analysis, Regression Techniques.

I am Master in Statistics from Indian Institute of Technology, Kanpur.

I have been teaching students for various University entrance exams and passing grades in Graduation and Post-Graduation.I have expertise in solving problems in Statistics for more than 2 years now.I am a subject expert in Statistics with Assignmentpedia.com.

4.40+

3+ Reviews

10+ Question Solved

Related Book For

Pearsons Federal Taxation 2023 Comprehensive

ISBN: 9780137840656

36th Edition

Authors: Timothy J. Rupert, Kenneth E. Anderson, David S Hulse

Question Posted:

Students also viewed these Business questions

-

Refer to the facts of problem 44. Write a letter to Grant Industries explaining why it might want to recognize the entire gain on the condemnation.

-

Refer to the facts of problem 44. Write a letter to Grant Industries explaining why it might want to recognize the entire gain on the condemnation. In Problem 44 Grant Industries' warehouse is...

-

Refer to the facts of Problem 12-36and assume the current year is 2015. Emilys prior gifts are as follows: Year Amount of Taxable Gifts 1974 .. $ 500,000 1998 .. 1,000,000 What is Emilys 2015 gift...

-

Read the case study of Statistics regarding the Lawler Grocery Store chain. The use of the sign test is demonstrated in this case study. In your opinion, what is the biggest benefit of the sign test?...

-

Two plane mirrors, M1 and M2, are placed together as illustrated in Fig. 22.25. (a) If the angle α between the mirrors 70o is and the angle of incidence, θi1 of a light ray...

-

Make a conscious study of your language at work. Resolve to reduce or eliminate negative language while increasing your focus on positive terms. lop4

-

1 A distributor for Celanese Chemical Company stores large quantities of chemicals, blends these chemicals to satisfy the requests of customers, and delivers the blends to a customers warehouse...

-

The box plot shows the undergraduate in-state charge per credit hour at four-year public colleges. a. Estimate the median. b. Estimate the first and third quartiles. c. Determine the interquartile...

-

Splish needs to calculate the company's expected cash receipts for the upcoming month to determine whether additional financing is needed. Typically, the company's sales consist of 40% cash sales and...

-

Prime Essentials Ltd. is a small private corporation. The owner plans to approach the bank for an additional loan or a line of credit to facilitate expansion. The company bookkeeper, after discussion...

-

Amir made taxable gifts as follows: $800,000 in 1975, $1.2 million in 1999, and $600,000 in 2022. What is Amirs gift tax liability for 2022?

-

In 2022, Sondra makes taxable gifts aggregating $300,000. Her only other taxable gifts amount to $200,000, all of which she made in 1997. a. What is Sondras 2022 gift tax liability? b. What is her...

-

In the hand simulation of the simple processing system, suppose the drill press is taken down for burn-in maintenance at time 4 minutes, and it takes 4 minutes to do this work and bring it back up;...

-

The following information appears in the records of Poco Corporation at year-end: a. Calculate the amount of retained earnings at year-end. b. If the amount of the retained earnings at the beginning...

-

For the following four unrelated situations, A through D, calculate the unknown amounts appearing in each column: A B D Beginning Assets... $38,000 $22,000 $38,000 ? Liabilities.. 22,000 15,000...

-

On December 31, John Bush completed his first year as a financial planner. The following data are available from his accounting records: a. Compute John's net income for the year just ended using the...

-

Statement of Stockholders' Equity and Balance Sheet The following is balance sheet information for Flush Janitorial Service, Inc., at the end of 2019 and 2018: Required a. Prepare a balance sheet as...

-

Petty Corporation started business on January 1, 2019. The following information was compiled by Petty's accountant on December 31, 2019: Required a. You have been asked to assist the accountant for...

-

A ray of yellow light from a sodium discharge lamp falls on the surface of a diamond in air at 45. If at that frequency n d = 2.42, compute the angular deviation suffered upon transmission.

-

The production budget of Artest Company calls for 80,000 units to be produced. If it takes 30 minutes to make one unit and the direct labor rate is $16 per hour, what is the total budgeted direct...

-

Describe forces that act as stimulants to change.

-

Describe the sources of resistance to change.

-

Summarize Lewin's three-step change model.

-

7 . 4 3 Buy - side vs . sell - side analysts' earnings forecasts. Refer to the Financial Analysts Journal ( July / August 2 0 0 8 ) study of earnings forecasts of buy - side and sell - side analysts,...

-

Bond P is a premium bond with a coupon of 8.6 percent , a YTM of 7.35 percent, and 15 years to maturity. Bond D is a discount bond with a coupon of 8.6 percent, a YTM of 10.35 percent, and also 15...

-

QUESTION 2 (25 MARKS) The draft financial statements of Sirius Bhd, Vega Bhd, Rigel Bhd and Capella for the year ended 31 December 2018 are as follows: Statement of Profit or Loss for the year ended...

Study smarter with the SolutionInn App