Roberta is a self-employed accountant. During the year, Roberta incurs the following unreimbursed expenses: Identify which of

Question:

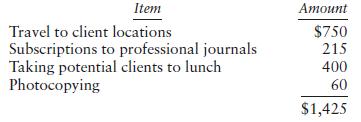

Roberta is a self-employed accountant. During the year, Roberta incurs the following unreimbursed expenses:

Identify which of these expenses are deductible and the amount that is deductible by Roberta. Indicate whether they are deductible for or from AGI.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Pearsons Federal Taxation 2023 Comprehensive

ISBN: 9780137840656

36th Edition

Authors: Timothy J. Rupert, Kenneth E. Anderson, David S Hulse

Question Posted: