Blue Corporation, a manufacturing company, decided to develop a new line of merchandise. The project began in

Question:

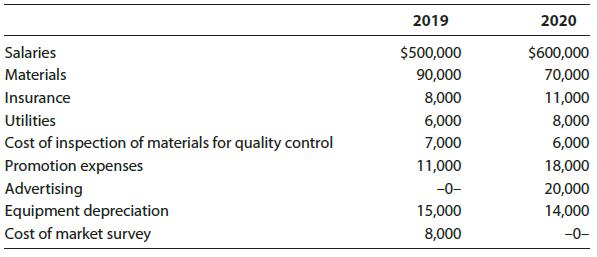

Blue Corporation, a manufacturing company, decided to develop a new line of merchandise. The project began in 2019. Blue had the following expenses in connection with the project:

The new product will be introduced for sale beginning in July 2021. Determine the amount of the deduction for research and experimental expenditures for 2019, 2020, and 2021 if:

a. Blue Corporation elects to expense the research and experimental expenditures.

b. Blue Corporation elects to amortize the research and experimental expenditures over 60 months.

CorporationA Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

South-Western Federal Taxation 2020 Essentials Of Taxation Individuals And Business Entities

ISBN: 9780357109175

23rd Edition

Authors: Annette Nellen, James C. Young, William A. Raabe, David M. Maloney

Question Posted: