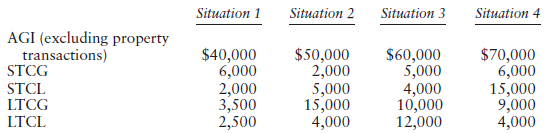

Consider the four independent situations below for an unmarried individual, and analyze the effects of the capital

Question:

Transcribed Image Text:

Situation 2 Situation 4 Situation 1 Situation 3 AGI (excluding property transactions) STCG $60,000 $40,000 $50,000 $70,000 6,000 2,000 3,500 2,500 2,000 5,000 4,000 10,000 15,000 STCL 5,000 15,000 4,000 9,000 LTCL 4,000 12,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 75% (12 reviews)

Situation 1 Situation 2 Situation 3 Situation 4 A...View the full answer

Answered By

Charles mwangi

I am a postgraduate in chemistry (Industrial chemistry with management),with writing experience for more than 3 years.I have specialized in content development,questions,term papers and assignments.Majoring in chemistry,information science,management,human resource management,accounting,business law,marketing,psychology,excl expert ,education and engineering.I have tutored in other different platforms where my DNA includes three key aspects i.e,quality papers,timely and free from any academic malpractices.I frequently engage clients in each and every step to ensure quality service delivery.This is to ensure sustainability of the tutoring aspects as well as the credibility of the platform.

4.30+

2+ Reviews

10+ Question Solved

Related Book For

Federal Taxation 2018 Comprehensive

ISBN: 9780134532387

31st Edition

Authors: Thomas R. Pope, Timothy J. Rupert, Kenneth E. Anderson

Question Posted:

Students also viewed these Business questions

-

Each of the four independent situations below describes a direct financing lease in which annual lease payments of $100,000 are payable at the beginning of each year. Each is a capital lease for the...

-

Each of the four independent situations below describes a capital lease in which annual lease payments are payable at the beginning of each year. Determine the annual lease payments foreach:...

-

Each of the four independent situations below describes a lease requiring annual lease payments of $10,000. For each situation, determine the appropriate lease classification by the lessee and...

-

A Canadian packaging company wished to extend its activities in the area of convenience foods. It had pinpointed one particular area where it could supply pizza boxes to half a dozen chains of pizza...

-

Use the Fourier transform to find i (t) in the network shown if vi (t) = 2e-t u (t).

-

Use a Maclaurin series in Table 1 to obtain the Maclaurin series for the given function. Table 1 1 2x" = 1 + x + x? + x + ... R = 1 n=0 00 x" e* = E- n=0 n! 1 + 1! R = 0 2! + 3! x2n+1 E(-1)" - x7 sin...

-

What factors create a foreign exchange gain on a foreign currency transaction? What factors create a foreign exchange loss? LO9

-

Following is a list of advantages and disadvantages of the corporate form of business. 1. Ownership and management are separated. 2. Has continuous life. 3. Transfer of ownership is easy. 4....

-

Which taxpayer(s) will be required to file a 2021 federal income tax return? None of the individuals are blind. -Andrew (32) has gross income of $3,500. His filing status is married filing...

-

Randomized block design: Researchers interested in identifying the optimal planting density for a type of perennial grass performed the following randomized experiment: Ten different plots of land...

-

An investor in a 28% tax bracket owns land that is a capital asset with a $50,000 basis and a holding period of three years. The investor wishes to sell the asset at a price high enough so that he...

-

To better understand the rules for offsetting capital losses and how to treat capital losses carried forward, analyze the following data for an unmarried individual for the period 2014 through 2017....

-

Solve each equation on 0 < 2. 4sin 2 - 3 = 0

-

do you agree wih this approach to dismantling the toxic culture? explain

-

Movies When randomly selecting a speaking character in a movie, the probability of getting a female is 0.331 (based on data from "Inequality in 1200 Popular Films," by Smith, et al., Annenberg...

-

Steve Reese is a well-known interior designer in Fort Worth, Texas. He wants to start his own business and convinces Rob O'Donnell, a local merchant, to contribute the capital to form a partnership....

-

Exercise 6-10A (Algo) Double-declining-balance and units-of-production depreciation: gain or loss on disposal LO 6-3, 6-4, 6-5 Exact Photo Service purchased a new color printer at the beginning of...

-

Independent Events Again assume that when randomly selecting a speaking character in a movie, the probability of getting a female is 0.331, as in Exercise 1. If we want to find the probability of 20...

-

Find each sum or difference. -3.8 + 6.2

-

Before the latest financial crisis and recession, when was the largest recession of the past 50 years, and what was the cumulative loss in output over the course of the slowdown?

-

Hal and Wanda, his wife, are in the 35% marginal tax bracket in the current year. Wanda fraudulently omits from their joint return $50,000 of gross income. Hal does not participate in or know of her...

-

Frank, a calendar year taxpayer, reports $100,000 of gross income and $60,000 of taxable income on his Year 1 return, which he files on March 12 of Year 2. He fails to report on the return a $52,000...

-

Refer to the previous problem. Assume Frank subsequently commits fraud with respect to his Year 1 return as late as October 8, of Year 3. When does the limitations period for charging Frank with...

-

essential con Example 15: Mr. Sunil Mukharjee has estimated probable under different macroeconomic conditions for the following three stocks: Stock Current Price (Rs.) Rates of return (%) during...

-

ABC Corporation has an activity - based costing system with three activity cost pools - Machining, Setting Up , and Other. The company's overhead costs, which consist of equipment depreciation and...

-

Consolidated Balance Sheets - USD ( $ ) $ in Thousands Dec. 3 1 , 2 0 2 3 Dec. 3 1 , 2 0 2 2 Current assets: Cash and cash equivalents $ 9 8 , 5 0 0 $ 6 3 , 7 6 9 Restricted cash 2 , 5 3 2 Short -...

Study smarter with the SolutionInn App