Dana manages real estate and is a cash method taxpayer. She changes to the accrual method in

Question:

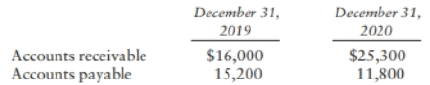

Dana manages real estate and is a cash method taxpayer. She changes to the accrual method in 2020. Dana's business income for 2020 is 530,000 computed on the accrual method. Her books show the following:

a. What adjustment is necessary to Dana's income?

b. How should Dana report the adjustment?

Transcribed Image Text:

Accounts receivable Accounts payable December 31, 2019 $16,000 15,200 December 31, 2020 $25,300 11,800

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 50% (6 reviews)

a The amount of the adjustment is 800 16000 15200 The receivables have not ...View the full answer

Answered By

JAPHETH KOGEI

Hi there. I'm here to assist you to score the highest marks on your assignments and homework. My areas of specialisation are:

Auditing, Financial Accounting, Macroeconomics, Monetary-economics, Business-administration, Advanced-accounting, Corporate Finance, Professional-accounting-ethics, Corporate governance, Financial-risk-analysis, Financial-budgeting, Corporate-social-responsibility, Statistics, Business management, logic, Critical thinking,

So, I look forward to helping you solve your academic problem.

I enjoy teaching and tutoring university and high school students. During my free time, I also read books on motivation, leadership, comedy, emotional intelligence, critical thinking, nature, human nature, innovation, persuasion, performance, negotiations, goals, power, time management, wealth, debates, sales, and finance. Additionally, I am a panellist on an FM radio program on Sunday mornings where we discuss current affairs.

I travel three times a year either to the USA, Europe and around Africa.

As a university student in the USA, I enjoyed interacting with people from different cultures and ethnic groups. Together with friends, we travelled widely in the USA and in Europe (UK, France, Denmark, Germany, Turkey, etc).

So, I look forward to tutoring you. I believe that it will be exciting to meet them.

3.00+

2+ Reviews

10+ Question Solved

Related Book For

Federal Taxation 2020 Comprehensive

ISBN: 9780135196274

33rd Edition

Authors: Timothy J. Rupert, Kenneth E. Anderson, David S. Hulse

Question Posted:

Students also viewed these Business questions

-

Dana manages real estate and is a cash method taxpayer. She changes to the accrual method in 2016. Danas business income for 2016 is $30,000 computed on the accrual method. Her books show the...

-

Dana manages real estate and is a cash method taxpayer. She changes to the accrual method in 2014. Dana's business income for 2014 is $30,000 computed on the accrual method. Her books show the...

-

Dana manages real estate and is a cash method taxpayer. She changes to the accrual method in 2018. Danas business income for 2018 is $30,000 computed on the accrual method. Her books show the...

-

Individual A is neither a trader nor a dealer for purposes of IRC 475. A purchases a single share of publicly traded Z stock for $1,000 on June 1, 2020. As of December 31, 2020, Z stock is trading at...

-

What are some examples of decisions that owners of small businesses make? What role can a lawyer play with respect to the making of these decisions?

-

Consider the evaporator and control system in Figure 13.6. (a) Should each control valve be air-to-open (AO) or air-to-close (AC)? (b) Should each PI controller be direct-acting or reverse-acting?...

-

Gross profit will result if (a) operating expenses are less than net income. (b) sales revenues are greater than operating expenses. (c) sales revenues are greater than cost of goods sold. (d)...

-

1. After taking into account the income that Sophia will receive from Social Security and her company sponsored pension plan, the financial planner has estimated that her investment assets will need...

-

Ambrose Tong is a Chief Financial Officer of a reputable clinic chain company. One of his main responsibility is to overlook the finance department. Ambrose is concerned about how effectively his...

-

[5] A marksman is firing a pistol at a 5 cm diameter, circular bullseye some distance away. The center of the target is considered (0, 0). This marksman pulls a little to the right (positive x) and a...

-

Jim Sarowski (SSN 000-00-2222) is 70 years old and single. He received Social Security benefits of $16,000. He works pan-time as a greeter at a local discount store and received wages of $7,300....

-

Bobby's marginal tax rate has been low for several years because his sole proprietorship has had low profits. Therefore, he has not elected Sec. 179 expensing, elected out of bonus depreciation, and...

-

What does HIPAA stand for and what does it protect? List the three factors that must be in place to comply with HIPAA?

-

Write out the form of the partial fraction decomposition of the function (See Example). Do not determine the numerical values of the coefficients. (If the partial fraction decomposition does not...

-

Listed here are the costs associated with the production of 1,000 drum sets manufactured by TrueBeat. Costs 1. Plastic for casing$16,000 2. Wages of assembly workers$83,000 3. Property taxes on...

-

The diagram shows the instant when a long slender bar of mass 4.8 kg and length 2.9 m is horizontal. At this instant the mass m= 6.2 kg has a vertical velocity of 5.3 m/s. If the pulley has...

-

Holland has been down to the Law Clinic and has returned with several new cases/clients; Wanda and the doorman from the 7-Seas Bar/Grill,Wanda, who has been charged with malicious destruction of a...

-

2) A spring of constant k=1.2 N/cm is being compressed 5-cm by a 200-gram ball. The ball is released on a 10 degree incline. Determine: a) The speed of the ball when it leaves the spring b) The...

-

Write an equation for each ellipse.

-

Design an experiment to demonstrate that RNA transcripts are synthesized in the nucleus of eukaryotes and are subsequently transported to the cytoplasm.

-

Matulis, Inc., a calendar year C corporation, owns a single asset with a basis of $325,000 and a fair market value of $800,000. Matulis holds a positive E & P balance. It elects S corporation status...

-

Based upon the following facts about Aqua, Inc., a calendar year S corporation, prepare the entity's Schedule M-2. AAA, beginning of the year.............................................$ 9,400...

-

Wong, Inc., a 501(c)(3) organization, is a private foundation with a tax year that ends on May 31. Gross receipts for the fiscal year are $180,000, and the related expenses are $160,000. a. Is the...

-

20 On January 1, Year 1, X Company purchased equipment for $80,000. The company estimates that the equipment will have a useful life of 10 years and a residual value of $5,000. X Company depreciates...

-

Discuss why it is important for company managers to understand and use social capital knowledge to help build social ties among their skilled knowledge workers so they can build employee loyalty...

-

Kate lives in a house close to a local university, and she traditionally has rented a garage apartment in the back of her property to students for $750 per month. Kate wants to transfer the title to...

Study smarter with the SolutionInn App