During 2019, Pam incurred the following casualty losses: All of the items were destroyed in the same

Question:

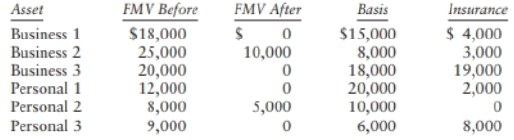

During 2019, Pam incurred the following casualty losses:

All of the items were destroyed in the same casualty, which resulted from a federally declared disaster. Before considering the casualty items, Pam reports business income of $80,000, qualified residential interest of 56,000 property taxes on her personal residence of $2,000, and charitable contributions of $4,000. Compute Pam's taxable income for 2019. Pam is single.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Federal Taxation 2020 Comprehensive

ISBN: 9780135196274

33rd Edition

Authors: Timothy J. Rupert, Kenneth E. Anderson, David S. Hulse

Question Posted: