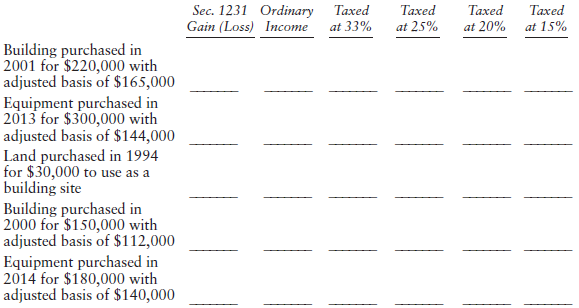

Glen, whose tax rate is 33%, sells each of the following assets for $200,000. Each case is

Question:

Transcribed Image Text:

Sec. 1231 Ordinary Gain (Loss) Income Тахed Тахed Тахed Тахed at 33% at 20% at 25% at 15% Building purchased in 2001 for $220,000 with adjusted basis of $165,000 Equipment purchased in 2013 for $300,000 with adjusted basis of $144,000 Land purchased in 1994 for $30,000 to use as a building site Building purchased in 2000 for $150,000 with adjusted basis of $112,000 Equipment purchased in 2014 for $180,000 with adjusted basis of $140,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 60% (10 reviews)

Sec 1231 Gain Loss Ordinary Income Taxed at 33 Taxed at 25 Taxed at 20 Taxed at 15 Building purchas...View the full answer

Answered By

Charles Okinda

students should give all the instructions concerning the challenge that they face. they will get an immediate response because I am always online.

4.90+

754+ Reviews

1483+ Question Solved

Related Book For

Federal Taxation 2018 Comprehensive

ISBN: 9780134532387

31st Edition

Authors: Thomas R. Pope, Timothy J. Rupert, Kenneth E. Anderson

Question Posted:

Students also viewed these Business questions

-

Each of the following independent events requires a year-end adjusting entry. Record each event and the related adjusting entry in general journal format. The first event is recorded as an example....

-

Each of the following independent events requires a year-end adjusting entry. Show how each event and its related adjusting entry affect the accounting equation. Assume a December 31 closing date....

-

Each of the following independent situations represents amounts shown on the four basic financial statements. 1. Revenues = $25,000; Expenses = $17,000; Net income = __________. 2. Increase in...

-

In its first year of operation, Oriole Printing Shop estimated manufacturing overhead costs and activity in order to determine a predetermined overhead rate. At year end, March 31, overhead was...

-

You are using a new release of an application software package. You think that you have discovered a bug. Outline the approach that you would take to confirm that it is indeed a bug. What actions...

-

How can a cost hierarchy lead to a more accurate costing system?

-

On February 1, Piscina Corporation completed a combination with Swimwear Company accounted for as a pooling of interests. At that date, Swimwears account balances were as follows: Inventory. Land....

-

Tyrell Co. entered into the following transactions involving short-term liabilities in 2016 and 2017. 2016 Apr. 20 Purchased $40,250 of merchandise on credit from Locust, terms n30. Tyrell uses the...

-

please show work! thanks! Goliath Corporation is in the process of setting a selling price for a new product it has just designed. The following data related to this product for a budgeted volume of...

-

Nance Network Consultants, Incorporated uses the percentage- of- completion method to account for its long- term contracts. It uses the cost- to- cost approach to measure progress. During the current...

-

Mr. Briggs purchased an apartment complex on January 10, 2015, for $2 million with 10% of the price allocated to land. He sells the complex on October 22, 2017, for $2.5 million. Assume that 10% of...

-

In 2011, Jack purchased undeveloped oil and gas property for $900,000 and paid $170,000 for intangible drilling and development costs. He elected to expense the intangible drilling and development...

-

Is JetBlue likely to continue being successful in building customer relationships? Why or why not? In 2007, JetBlue was a thriving young airline with a strong reputation for outstanding service. In...

-

Archer Contracting repaved 50 miles of two-lane county roadway with a crew of six employees. This crew worked 8 days and used \($7,000\) worth of paving material. Nearby, Bronson Construction repaved...

-

An insurance company has the following profitability analysis of its services: The fixed costs are distributed equally among the services and are not avoidable if one of the services is dropped. What...

-

The Scantron Company makes bar-code scanners for major supermarkets. The sales staff estimates that the company will sell 500 units next year for 10,000 each. The production manager estimates that...

-

Determine the following: a. The stockholders equity of a company that has assets of \(\$ 625,000\) and liabilities of \(\$ 310,000\). b. The retained earnings of a company that has assets of \(\$...

-

You are the manager of internal audit for Do-It-All, Ltd., a large, diversified, decentralized manufacturing company. Over the past two years, the information systems function in Do-It-All has...

-

The following function gives the distance in feet a car going approximately 68 mph will skid in t seconds. Find the time it would take for the car to skid 180 ft. D(t) = 13t 100t

-

Economic feasibility is an important guideline in designing cost accounting systems. Do you agree? Explain.

-

In 2015, Ginger Graham, age 46 and wife of Greg Graham engaged in the transactions described below. Determine Gingers gift tax liability for 2015 if she and Greg elect gift splitting and Greg gave...

-

George and Martha, spouses, made a number of gifts during 2015. Their accountant is trying to help them decide whether to elect gift splitting. If they elect gift splitting, each spouse will have $4...

-

Ilene Ishi is planning to fund an irrevocable charitable remainder annuity trust with $100,000 of cash. She will designate her sister, age 60, to receive an annuity of $5,000 per year for 15 years...

-

How to solve general ledger cash balance chapter 9 assignment 5

-

On 31 July 2018, Sipho bought 1 000 ordinary shares in ABC Ltd at a cost of R2 750. On 31 December 2018 the company made a 1 for 10 bonus issue. On 31 March 2019, Sipho sold 300 shares for R800. What...

-

If you purchase a $1000 par value bond for $1065 that has a 6 3/8% coupon rate and 15 years until maturity, what will be your annual return? 5.5% 5.9% 5.7% 6.1%

Study smarter with the SolutionInn App