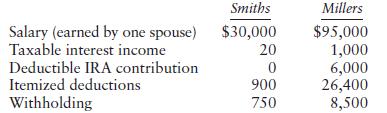

The following information relates to two married couples: Compute the 2022 tax due or refund due for

Question:

The following information relates to two married couples: Compute the 2022 tax due or refund due for each couple. Assume that any restrictions on itemized deductions have been applied. Ignore credits.

Compute the 2022 tax due or refund due for each couple. Assume that any restrictions on itemized deductions have been applied. Ignore credits.

Transcribed Image Text:

Salary (earned by one spouse) Taxable interest income Deductible IRA contribution Itemized deductions Withholding Smiths $30,000 20 0 900 750 Millers $95,000 1,000 6,000 26,400 8,500

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 71% (7 reviews)

Salary Taxable interest income Gross Income Minus IRA Contribution A...View the full answer

Answered By

Niala Orodi

I am a competent and an experienced writer with impeccable research and analytical skills. I am capable of producing quality content promptly. My core specialty includes health and medical sciences, but I can competently handle a vast majority of disciplines.

5.00+

1+ Reviews

10+ Question Solved

Related Book For

Pearsons Federal Taxation 2023 Individuals

ISBN: 9780137700127

36th Edition

Authors: Timothy J. Rupert, Kenneth E. Anderson, David S Hulse

Question Posted:

Students also viewed these Business questions

-

The following information relates to two married couples: Compute the 2018 tax due or refund due for each couple. Assume that any restrictions on itemized deductions have been applied. Ignore...

-

The following information relates to two married couples: Falzones Falbos Salary (earned by one spouse) $32,000 $145,000 Taxable interest income 80 1,300 Deductible IRA contribution 0 6,000 Itemized...

-

The following information relates to two married couples: Compute the 2016 tax due or refund due for each couple. Assume that the itemized deductions have been reduced by the applicable floors....

-

What's New 14 el.alphacollege.ca 500 Alpha College E-learning of My Courses Development is informal with a loner-term focus Select one: O True O False Training is formal with a short-term focus....

-

While going to work this morning off site from his office, an engineer accidently ran a stop sign and was in a car accident that resulted in the death of a 5-year-old child. He has a strong belief in...

-

How did it go through the seven phases of change that we saw earlier? lop4

-

Following are separate income statements for Alexander, Inc., and Raleigh Corporation as well as a consolidated statement for the business combination as a whole. LO4 Alexander Raleigh Consolidated...

-

In the aftermath of a hurricane, an entrepreneur took a one-month leave of absence (without pay) from her $4,000 per month job in order to operate a kiosk that sold fresh drinking water. During the...

-

Woodside Woodside provides a fascinating case study for risk governance. As a major oil and gas producer, the firm must grapple with the world's transition to new energy. CEO Meg O'Neill was formally...

-

John and Carole file a joint return and have three children: Jack, David, and Kristen. All three children live at home the entire year. Below is information about each of the children for 2022: Jack...

-

Jill and George are married and file a joint return. They expect to have $450,000 of taxable income in the next year and are considering whether to purchase a personal residence that would provide...

-

Calculate interest on and determine the due date of promissory notes.

-

Implement the nearest neighbor algorithm in the programming language of your choice. The algorithm should work with vectors of up to 10 integer values and allow up to 10 integer classifications. By...

-

Use the operators described in Section 16.2.4 and the STRIPS method to solve the block world planning problem shown in Figure 16.11. The first state shown is the start state and the second state is...

-

Implement a Bayesian belief network in the programming language of your choice to represent a subject in which you are interested (for example, you might use it to diagnose medical conditions from...

-

Researchers have measured the acceleration of racing greyhounds as a function of their speed; a simplified version of their results is shown in Figure P4.67. The acceleration at low speeds is...

-

If the rate at which energy is dissipated by resistor 1 in Figure P31.86 is \(2.5 \mathrm{~W}\), and \(R_{1}=10 \Omega, \mathscr{E}_{1}=12 \mathrm{~V}\), and \(\mathscr{E}_{2}=6 \mathrm{~V},\) (a)...

-

IceCap Hotels operates a series of northern European hotels and reports under IFRS. On June 30, 2016, IceCap purchased land for 3,000,000. IceCap reports land values on the balance sheet under...

-

Evaluate the function at the given value(s) of the independent variable. Simplify the results. (x) = cos 2x (a) (0) (b) (- /4) (c) (/3) (d) ()

-

The following information relates to two married couples: Lanes Waynes Salary (earned by one spouse) $32,000 $115,000 Taxable interest income 1,000 10,000 Deductible IRA contribution 5,500 0 Itemized...

-

The following information relates to Tom, a single taxpayer, age 18: Salary .$1,800 Taxable interest income .. 1,600 Itemized deductions 600 a. Compute Toms taxable income assuming he is...

-

Carl and Carol have salaries of $14,000 and $22,000, respectively. Their itemized deductions total $8,500. They are married and both are under age 65. a. Compute their taxable income assuming they...

-

Suppose I have computed the cost of carbon per mile for my car at 0 . 0 1 2 per mile. Assume that the interest rate is 4 % and that I drive the car 2 8 , 0 0 0 miles per year. What is the present...

-

Imagine that in stable growth period, the firm earns ROIC of 10% and has after tax EBIT of 200 and reinvestment $ of 40. What is the steady state growth rate? 20% O 10% 2%

-

Tanner-UNF Corporation acquired as a long-term investment $160 million of 5.0% bonds, dated July 1, on July 1, 2021. Company management has the positive intent and ability to hold the bonds until...

Study smarter with the SolutionInn App