Using Exhibit 28.4 as a guide, describe the computation of a fiduciary entitys accounting income, taxable income,

Question:

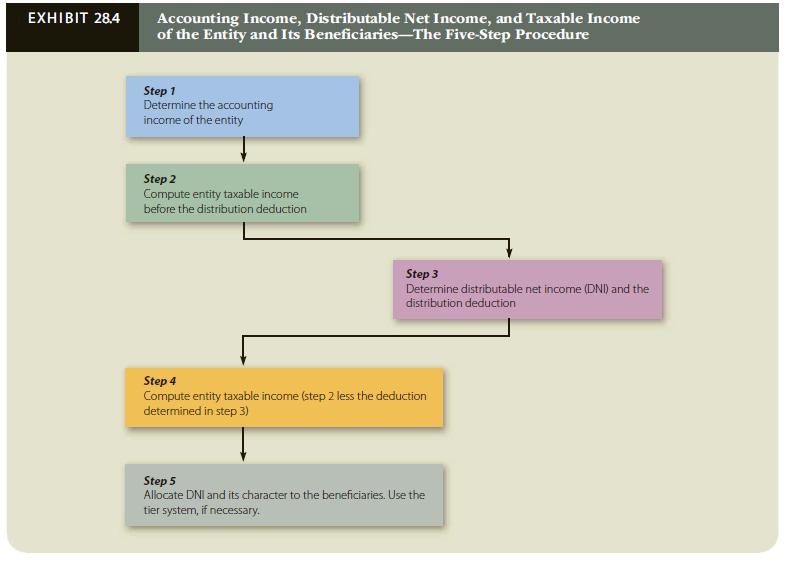

Using Exhibit 28.4 as a guide, describe the computation of a fiduciary entity’s accounting income, taxable income, and distributable net income.

Exhibit 28.4

Transcribed Image Text:

EXHIBIT 28.4 Accounting Income, Distributable Net Income, and Taxable Income of the Entity and Its Beneficiaries-The Five-Step Procedure Step 1 Determine the accounting income of the entity Step 2 Compute entity taxable income before the distribution deduction Step 3 Determine distributable net income (DNI) and the distribution deduction Step 4 Compute entity taxable income (step 2 less the deduction determined in step 3) Step 5 Allocate DNI and its character to the beneficiaries. Use the tier system, if necessary.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 50% (12 reviews)

ANSWER Exhibit 284 outlines the fivestep procedure for computing the accounting income taxable income and distributable net income of a fiduciary enti...View the full answer

Answered By

Chandrasekhar Karri

I have tutored students in accounting at the high school and college levels. I have developed strong teaching methods, which allow me to effectively explain complex accounting concepts to students. Additionally, I am committed to helping students reach their academic goals and providing them with the necessary tools to succeed.

0.00

0 Reviews

10+ Question Solved

Related Book For

South-Western Federal Taxation 2018 Comprehensive

ISBN: 9781337386005

41st Edition

Authors: David M. Maloney, William H. Hoffman, Jr., William A. Raabe, James C. Young

Question Posted:

Students also viewed these Business questions

-

Using Exhibit 20.4 as a guide, describe the computation of a fiduciary entitys accounting income, taxable income, and distributable net income. Step 1 Determine the accounting Income of the entity...

-

Describe the computation of noncontrolling interest share for an 80%-owned subsidiary with both preferred and common stock outstanding.

-

Describe the computation of free cash flow. What is its relevance to financial analysis?

-

The last two decades have taught us that when it comes to financial deregulation, it is possible to have too much of a good thing too quickly. Financial deregulation has often taken place...

-

h(x) = (2 - x2)ex. Compute the first and second derivatives of the above function.

-

Appreciate the spread of casino gaming across the United States and throughout the world.

-

Discuss postpurchase outcomes.

-

On January 1, 2017, Pluto Company acquired all of Saturn Company's common stock for $1,000,000 cash. On that date, Saturn had retained earnings of $200,000 and common stock of $600,000. The book...

-

Portsmouth Company makes upholstered furniture. Its only variable cost is direct materials. The demand for the company's products far exceeds its manufacturing capacity. The bottleneck (or...

-

In a public sector company, the workers are very lazy and do not do their allotted jobs in the stipulated time. The vice-president calls the manager and questions him about the situation. The manger...

-

Before her death, Lucy entered into the following transactions. a. Lucy borrowed $600,000 from her brother, Irwin, so that Lucy could start a business. The loan was on open account, and no interest...

-

The Sterling Trust owns a business and generated $100,000 in depreciation deductions for the tax year. Mona is one of the income beneficiaries of the entity. a. Given the following information,...

-

1. Which of Kents 6 ways to keep stress under control do you think might work for a project manager at Twitter? 2. Would you like Norlens job? Why (not)? 3. Is it possible in a fast-growth company to...

-

Lazlo s estimates uncollectible accounts to be 0 . 9 % of sales. Its year - end unadjusted trial balance shows Accounts Receivable of $ 1 1 2 , 5 0 0 and sales of $ 9 6 5 , 0 0 0 . If Lazlo s uses...

-

Identify one or two of the best and one or two of the worst work teams on which you served as a member. 1. Identify the top three to five factors that made the team the best or the worst in terms of...

-

ColorCoder is a HousePaint Shop which supplies currently two types of house paints, namely, alpha and beta house paints. The shop is planning to sell a primer (paint base) and the needed paint...

-

which department adds value to a product or service that is observable by a customer?

-

Using Figure 14.1, answer the following questions: a. What was the settle price for July 2022 coffee futures on this date? What is the total dollar value of this contract at the close of trading for...

-

Perl allows both static and a kind of dynamic scoping. Write a Perl program that uses both and clearly shows the difference in effect of the two. Explain clearly the difference between the dynamic...

-

1. Use these cost, revenue, and probability estimates along with the decision tree to identify the best decision strategy for Trendy's Pies. 2. Suppose that Trendy is concerned about her probability...

-

Rosas employer has instituted a flexible benefits program. Rosa will use the plan to pay for her daughters dental expenses and other medical expenses that are not covered by health insurance. Rosa is...

-

How does the tax benefit rule apply in the following cases? a. In 2012, the Orange Furniture Store, an accrual method taxpayer, sold furniture on credit for $1,000 to Sammy. The cost of the furniture...

-

Alfred E. Old and Beulah A. Crane, each age 42, married on September 7, 2011. Alfred and Beulah will file a joint return for 2013. Alfreds Social Security number is 111-11- 1111. Beulahs Social...

-

crane Inc. common chairs currently sell for $30 each. The firms management believes that it's share should really sell for $54 each. If the firm just paid an annual dividend of two dollars per share...

-

Determine the simple interest earned on $10,000 after 10 years if the APR is 15%

-

give me an example of 10 transactions from daily routine that we buy and put for me Liabilities + Owners' Equity + Revenues - Expenses

Study smarter with the SolutionInn App