Wayne is single and has no dependents. Without considering his $11,000 adjusted net capital gain (ANCG), his

Question:

a. What is Wayne€™s tax liability without the ANCG?

b. What is Wayne€™s tax liability with the ANCG?

Transcribed Image Text:

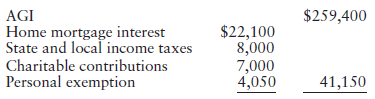

AGI Home mortgage interest State and local income taxes |Charitable contributions Personal exemption $259,400 $22,100 8,000 7,000 4,050 41,150

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 62% (8 reviews)

a 555524627875 33 x 218250 190150 b 57444 Medicare tax on net investment income o...View the full answer

Answered By

Gilbert Chesire

I am a diligent writer who understands the writing conventions used in the industry and with the expertise to produce high quality papers at all times. I love to write plagiarism free work with which the grammar flows perfectly. I write both academics and articles with a lot of enthusiasm. I am always determined to put the interests of my customers before mine so as to build a cohesive environment where we can benefit from each other. I value all my clients and I pay them back by delivering the quality of work they yearn to get.

4.80+

14+ Reviews

49+ Question Solved

Related Book For

Federal Taxation 2017 Individuals

ISBN: 9780134420868

30th Edition

Authors: Thomas R. Pope, Timothy J. Rupert, Kenneth E. Anderson

Question Posted:

Students also viewed these Business questions

-

Eric is single and has no dependents for 2020. He earned $60,000 and had deductions from gross income of $1,800 and itemized deductions of $12,600. Compute Erics income tax for the year using the Tax...

-

11) S'well manufactures and sells high quality, insulated water bottles made of stainless steel, in many fun colors and designs. S'well sells its water bottles to retail stores such as high-end...

-

Robert A. Kliesh, age 41, is single and has no dependents. Robert's Social Security number is 111-11-1111. His address is 201 Front Street, Missoula, MT 59812. He is independently wealthy as a result...

-

Marta purchased a home with an adjustable rate mortgage. The margin on an adjustable-rate mortgage is 5.5% and the rate cap is 6.5% over the life of the loan. If the current index rate is 8.9%, find...

-

List and define the basic organizational structures.

-

Kent Duncan is exploring the possibility of opening a self-service car wash and operating it for the next five years until he retires. He has gathered the following information: a. A building in...

-

16. Suppose that the exchange rate is $0.92/=C. Let r$ = 4%, and r=C = 3%, u = 1.2, d = 0.9, T = 0.75, n = 3, and K = $0.85. a. What is the price of a 9-month European call? b. What is the price of a...

-

The Coca-Cola Company is a global soft drink beverage company (ticker symbol = KO) that is a primary and direct competitor with PepsiCo. The data in Exhibits 12.1312.15 include the actual amounts for...

-

Weighted Average Method, FIFO Method, Physical Flow, Equivalent Units Middelton Company manufactures a product that passes through two processes: Fabrication and Assembly. The following information...

-

Rockwell Wholesalers, Inc. has just completed its fourth year of business in 20X1. A set of financial statements was prepared by the principal stockholders eldest child, a college student who is...

-

Trisha, whose tax rate is 35%, sells the following capital assets in 2016 with gains and losses as shown: a. Determine Trishas increase in tax liability as a result of the three sales. All assets...

-

To better understand the rules for offsetting capital losses and how to treat capital losses carried forward, analyze the following data for an unmarried individual for the period 2013 through 2016....

-

Steering Rental Car uses a multicolumn cash receipts journal. Indicate which column(s) is/are posted only in total, only daily, or both in total and daily. LO4 1. Accounts Receivable 3. Cash 2. Sales...

-

What is brand awareness for Jam & Daisies ? their leaning advantage, consideration advantage, choice advantages? 5. what is the recommendation of brand awareness? 6. What is Brand recognition? 7....

-

On August 1st, Custom Car Co's work in process inventory was $24900; its raw materials inventory was $6000; manufacturing overhead had a $1800 debit balance. Work in Process Subsidiary Data 8/1:...

-

Case: Castoro & Partners, CPAs is auditing Cloud 9 for the FY2023. Cloud 9 is a small public company and has been an audit client of Castoro & Partners since 2018. Materiality Methodology: Overall...

-

1)Solve the following differential equations by Undetermined Coefficient Method. dy dx dy - 4- 4+ 4y = 16x2e2x dx

-

Every year Monty Industries manufactures 8,600 units of part 231 for use in its production cycle. The per unit costs of part 231 are as follows: Direct materials Direct labor Variable manufacturing...

-

Without using a calculator, give the value of each expression. In eV

-

How many years will it take a $700 balance to grow into $900 in an account earning 5%?

-

a. What determines who must file a tax return? b. Is an individual required to file a tax return if he or she owes no tax?

-

Many homeowners itemize deductions while many renters claim the standard deduction. Explain.

-

Tax rules are often very precise. For example, a taxpayer must ordinarily provide over 50% of another persons support in order to claim a dependency exemption. Why is the threshold over 50% as...

-

Suppose I have computed the cost of carbon per mile for my car at 0 . 0 1 2 per mile. Assume that the interest rate is 4 % and that I drive the car 2 8 , 0 0 0 miles per year. What is the present...

-

Imagine that in stable growth period, the firm earns ROIC of 10% and has after tax EBIT of 200 and reinvestment $ of 40. What is the steady state growth rate? 20% O 10% 2%

-

Tanner-UNF Corporation acquired as a long-term investment $160 million of 5.0% bonds, dated July 1, on July 1, 2021. Company management has the positive intent and ability to hold the bonds until...

Study smarter with the SolutionInn App