Will, a bachelor, died in 2017. At that time, his sole asset was cash of $6 million.

Question:

a. What was Will€™s estate tax base?

b. How would your answer to Part a change if Will made the first gift in 1974 (instead of 1987)?

Transcribed Image Text:

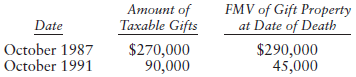

FMV of Gift Property at Date of Death Атоunt of Taxable Gifts $270,000 90,000 Date October 1987 October 1991 $290,000 45,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 72% (11 reviews)

a Gross estate and taxable estate 6000000 Plus Adjusted taxable gifts 360000 Es...View the full answer

Answered By

Nazrin Ziad

I am a post graduate in Zoology with specialization in Entomology.I also have a Bachelor degree in Education.I posess more than 10 years of teaching as well as tutoring experience.I have done a project on histopathological analysis on alcohol treated liver of Albino Mice.

I can deal with every field under Biology from basic to advanced level.I can also guide you for your project works related to biological subjects other than tutoring.You can also seek my help for cracking competitive exams with biology as one of the subjects.

3.30+

2+ Reviews

10+ Question Solved

Related Book For

Federal Taxation 2018 Comprehensive

ISBN: 9780134532387

31st Edition

Authors: Thomas R. Pope, Timothy J. Rupert, Kenneth E. Anderson

Question Posted:

Students also viewed these Business questions

-

Cate Cole died in 2014, and her will left her entire estate in equal shares to her two adult children, Calvin and Corrine. Both children anticipate being in the top income tax bracket for at least...

-

Will, a bachelor, died in 2014. At that time, his sole asset was cash of $6 million. Assume no debts or funeral and administration expenses and no charitable bequests. His gift history was as...

-

Will, a bachelor, died in 2013. At that time, his sole asset was cash of $6 million. Assume no debts or funeral and administration expenses. His gift history was as follows: a. What was Will's estate...

-

The population of a certain colony of bacteria increases by 5% each hour. After 7 hours, what is the percent increase in the population over the initial population?

-

A researcher uses a matched-subjects design to investigate whether single people who own pets are generally happier than singles without pets. A mood inventory questionnaire is administered to a...

-

Evaluate the integrals by Simpsons rule with 2m as indicated, and compare with the exact value known from calculus. Compute the integral J by Simpsons rule with 2m = 8 and use the value and that in...

-

The 2004 election. George Bush was reelected president in 2004 with 51.0% of the popular vote. His Democratic opponent, John Kerry, received 48.1% of the vote, with minor candidates taking the...

-

After the tangible assets have been adjusted to current market prices, the capital accounts of Brandon Newman and Latrell Osbourne have balances of $75,000 and $125,000, respectively. Juan Rivas is...

-

Carey Company had sales in 2019 of $1,923,000 on 64,100 units. Variable costs totaled $897,400, and fixed costs totaled $502,000. A new raw material is available that will decrease the variable costs...

-

Use Excel formulas and links to cells in order to answer the following questions. 1. Given the actual level of activity (number of cases of Nut muesli produced), what are the standard costs? In other...

-

Sam Snider died February 14, 2016, survived by his spouse Janet and several children. Sam had not made any taxable gifts. Sams gross estate was $7 million. In each of the following independent...

-

Bess, a widow, died in October 2017. Her gross estate, which totaled $7 million, included a $100,000 life insurance policy on her life that she gave away in 2015. The taxable gift that arose from...

-

Argone Division of Gemini Corporation is located in the United States. Its effective income tax rate is 20%. Another division of Gemini, Calcia, is located in Canada, where the income tax rate is...

-

MTB Surfboards has a P / E of 2 0 . The discount rate for this firm is 3 0 percent. They had earnings of $ 2 , 0 0 0 , 0 0 0 and 1 0 0 , 0 0 0 shares of common stock outstanding. What should be the...

-

Question 4 (20 marks) Laboratory 4: Superposition Theorem Objectives: 1. Understand the principles of a Superposition Theorem 2. Determine the characteristics of a Superposition Theorem...

-

2 Ursala, Inc., has a target debt-equity ratio of .65. Its WACC is 10.4 percent, and the tax rate is 23 percent. a. If the company's cost of equity is 14 percent, what is its pretax cost of debt? b....

-

Thinking about Nike's corporate practices, discuss your approach to starting a company that outsourced labor in order to reduce manufacturing costs. What decisions would you make to combine...

-

Owen Properties recently purchased a building in a community that is eligible for participation in the National Flood Insurance Program (NFIP). Under the regular program of the NFIP, the maximum...

-

Solve each inequality. (7-6x) -1

-

Write the statement to store the contents of the txtAge control in an Integer variable named intAge.

-

On February 15, 2017, Jamal, who is single and age 30, establishes a traditional IRA and contributes $5,500 to the account. Jamal's adjusted gross income is $67,000 in 2016 and $57,000 in 2017. Jamal...

-

On March 1, 2016, Sarah entered into a three-year lease of an automobile used exclusively in her business. The automobile's FMV was $58,500 at the inception of the lease. Sarah made ten monthly lease...

-

Woburn Corporation uses the calendar year as its tax year. Woburn purchases and places into service $850,000 of depreciable property during 2016: You are working in Woburn's tax department and are...

-

5. Which of the following is the cheapest for a borrower? a. 6.7% annual money market basis b. 6.7% semi-annual money market basis c. 6.7% annual bond basis d. 6.7% semi-annual bond basis.

-

Waterloo Industries pays 30 percent corporate income taxes, and its after-tax MARR is 24 percent. A project has a before-tax IRR of 26 percent. Should the project be approved? What would your...

-

Imagine you are an Investor in the Stock Market. Identify three companies in the Korean Stock Market (KOSPI) where you would like to invest. Explain your answer

Study smarter with the SolutionInn App