Woburn Corporation uses the calendar year as its tax year. Woburn purchases and places into service $1.7

Question:

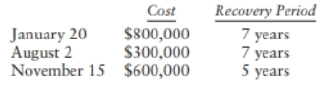

Woburn Corporation uses the calendar year as its tax year. Woburn purchases and places into service $1.7 million of depreciable property during 2019:

You are working in Woburn's tax department and are trying to decide how to make the Sec. 179 election so as to maximize Woburn's 2019 depreciation deduction. What tax issues should you consider for this decision?

Transcribed Image Text:

January 20 August 2 November 15 Cost $800,000 $300,000 $600,000 Recovery Period 7 years 7 years 5 years

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 75% (16 reviews)

1 The amount of the Section 179 deduction allowed The maximum amount of the Section 179 deduction th...View the full answer

Answered By

DHRUV RAI

As a tutor, I have a strong hands-on experience in providing individualized instruction and support to students of all ages and ability levels. I have worked with students in both one-on-one and group settings, and I am skilled in creating engaging and effective lesson plans that meet the unique needs of each student.

I am proficient in using a variety of teaching techniques and approaches, including problem-based learning, inquiry-based learning, and project-based learning. I also have experience in using technology, such as online learning platforms and educational software, to enhance the learning experience for my students.

In addition to my teaching experience, I have also completed advanced coursework in the subjects that I tutor, including mathematics, science, and language arts. This has allowed me to stay up-to-date on the latest educational trends and best practices, and to provide my students with the most current and effective teaching methods.

Overall, my hands-on experience and proficiency as a tutor have equipped me with the knowledge, skills, and expertise to help students achieve their academic goals and succeed in their studies.

0.00

0 Reviews

10+ Question Solved

Related Book For

Federal Taxation 2020 Comprehensive

ISBN: 9780135196274

33rd Edition

Authors: Timothy J. Rupert, Kenneth E. Anderson, David S. Hulse

Question Posted:

Students also viewed these Business questions

-

Woburn Corporation uses the calendar year as its tax year. Woburn purchases and places into service $850,000 of depreciable property during 2016: You are working in Woburn's tax department and are...

-

Woburn Corporation uses the calendar year as its tax year. Woburn purchases and places into service $850,000 of depreciable property during 2017: _________________________ Cost Recovery...

-

Woburn Corporation uses the calendar year as its tax year. Woburn purchases and places into service $1.7 million of depreciable property during 2018: You are working in Woburn's tax department and...

-

Suppose that the following equations describe an economy: C = 170 + 0.60YD M s = 735; P = 1 T = 200 I = 100 - 4i Md = 0.75Y - 6i G = 350 a) what is the equation for equilibrium in the goods market?...

-

Explain the difference between a bilateral contract and a unilateral contract.

-

Urn 1 contains 5 red balls and 3 black balls. Urn 2 contains 3 red balls and 1 black ball. Urn 3 contains 4 red balls and 2 black balls. If an urn is selected at random and a ball is drawn, find the...

-

What was your first job role and how long did it take to become a communications manager? LO.1

-

Longhorn Corporation provides low-cost food delivery services to senior citizens. At the end of the year, the company reports the following amounts: In addition, the company had common stock of...

-

I need the answer as soon as possible q140 Q.21. An investor holds shares in A Ltd. and B Ltd. in equal proportion with the following risk and return characteristics: Shares in A Shares in B Expected...

-

David R. and Ella M. Cole (ages 39 and 38, respectively) are husband and wife who live at 1820 Elk Avenue, Denver, CO 80202. David is a self-employed consultant specializing in retail management, and...

-

Turner Corporation uses the calendar year as its tax year. It purchases and places into service $1.97 million of property during 2019 to use in its business: What is Turner's total depreciation...

-

In 2019, Andes Corporation purchases $1.5 mil-lion of machinery (7-year property) and places it into service in its business. What are Andes' depreciation deductions for 2019 and 2020 in each of the...

-

Exercise 10.31 considered the following data on the number of hours students spent on social network sites per week: Enter the observations (separated by spaces) into the Permutation Test web app....

-

As shown on the attached chart, what is the approximate current 7-year spread premium for Kellogg Bonds? 25 Basis Points 75 Basis Points 200 Basis Points AUS Treasury Actives Curve X-ads Tenor...

-

A pharmaceutical company claims to have invented a new pill to aid weight loss. They claim that people taking these pills will lose more weight than people not taking them. A total of twenty people...

-

Let U = {a, b, c, d, e, f} be the universal set and let A = {a, b, c, d, e, f}. Write the set A. Remember to use correct set notation. Provide your answer below: A=

-

Produce a poster series of three (3) A3 sized posters on creativity in the early years. As a collective the poster series must articulate the importance of aesthetics and creativity for young...

-

Find the second derivative of the function. g(x) = ex In(x) g"(x) = Need Help? Read It

-

Find an equation for the hyperbola described. Graph the equation. Center at (-3, -4); focus at (-3, -8); vertex at (-3, -2)

-

As of January 1, 2018, Room Designs, Inc. had a balance of $9,900 in Cash, $3,500 in Common Stock, and $6,400 in Retained Earnings. These were the only accounts with balances in the ledger on January...

-

Mauve Corporation has a group hospitalization insurance plan that has a $200 deductible amount for hospital visits and a $15 deductible for doctor visits and prescriptions. The deductible portion...

-

Bertha is considering taking an early retirement offered by her employer. She would receive $3,000 per month, indexed for inflation. However, she would no longer be able to use the company's health...

-

Finch Construction Company provides the carpenters it employs with all of the required tools. However, the company believes that this practice has led to some employees not taking care of the tools...

-

Assume that gasoline costs $ 3 . 2 0 per gallon and you plan to keep either car for six years. How many miles per year would you need to drive to make the decision to buy the hybrid worthwhile,...

-

On January 1 , 2 0 2 4 , Pine Company owns 4 0 percent ( 1 2 0 , 0 0 0 shares ) of Seacrest, Incorporated, which it purchased several years ago for $ 6 7 8 , 0 0 0 . Since the date of acquisition,...

-

Typical impact on product costs from implementing ABC include: a. Shifting of manufacturing overhead costs from low volume products to high-volume products. b. Decreases in per unit costs of high...

Study smarter with the SolutionInn App