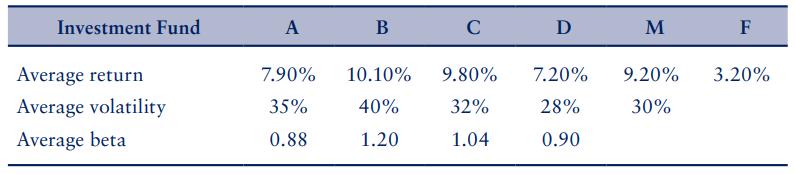

Below are the recent performances of four investment funds, a market index (M), and a risk-free asset

Question:

Below are the recent performances of four investment funds, a market index (M), and a risk-free asset (F):

a. Fill in the empty cells in the table above.

b. What are the alphas of the above portfolios? How did the investment funds perform?

Transcribed Image Text:

Investment Fund Average return Average volatility Average beta A B 7.90% 10.10% 35% 40% 0.88 1.20 C D M 9.80% 7.20% 9.20% 32% 28% 30% 1.04 0.90 F 3.20%

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 62% (8 reviews)

a The market has a beta of one the riskfree asset has a zero beta and a zero volatility b ...View the full answer

Answered By

Qurat Ul Ain

Successful writing is about matching great style with top content. As an experienced freelance writer specialising in article writing and ghostwriting, I can provide you with that perfect combination, adapted to suit your needs.

I have written articles on subjects including history, management, and finance. Much of my work is ghost-writing, so I am used to adapting to someone else's preferred style and tone. I have post-graduate qualifications in history, teaching, and social science, as well as a management diploma, and so am well equipped to research and write in these areas.

4.80+

265+ Reviews

421+ Question Solved

Related Book For

Finance For Executives Managing For Value Creation

ISBN: 9781473749245

6th Edition

Authors: Gabriel Hawawini, Claude Viallet

Question Posted:

Students also viewed these Business questions

-

Listed below are the recent annual compensation amounts for these chicf executive officers: Mulally (Ford), Jobs (Apple), Kent (Coca-Cola), Otellini (Intel), and McNerney (Boeing). The data are from...

-

Listed below are the recent annual compensation amounts (in thousands of dollars) for a random sample of chief executive officers (Mulally from Ford, Jobs from Apple, Kent from Coca-Cola, Otellini...

-

Below are two portfolios with a market value of $500 million. The bonds in both portfolios are trading at par value. The dollar duration of the two portfolios is the same. Answer the below questions....

-

Why does the cost to load in an unconstrained system is lower compared to contrained with N - 1 Contingency in PLEXOS Modelling? What are the factors that affect the increase in cost to load during...

-

The Peg Corporation (TPC) issued bonds and received cash in full for the issue price. The bonds were dated and issued on January 1, 2015. The stated interest rate was payable at the end of each year....

-

Eric is a new manager of product information for a national firm which wholesales electrical components. He's proud because he was assigned a 'tough' office right out of management training. He's...

-

17. Let S = \($40\), = 0.30, r = 0.08, T = 1, and = 0. Also let Q = \($60\), Q = 0.50, Q = 0, and = 0.5. In this problem we will compute prices of exchange calls with S as the price of the...

-

Assume that you have been assigned to the audit of Keystone after audit planning has occurred. Review the planning information on pages 235242 and the audit program for the accounts receivable and...

-

Please do part d only Please do part d only please show how to do part d and get these results: Question 1 On 3 September 2008, Coca-Cola Company offered to buy China's largest fruit juice company,...

-

Battery Limited uses a perpetual inventory system. The inventory records show the following data for its first month of operations: Calculate the cost of goods sold and ending inventory using (a)...

-

You want to test the speed with which stock market prices adjust to positive earnings announcements. Company A makes its earnings announcement on May 20 and Company B on June 16. You collected for...

-

The municipal government has imposed a temporary, five-year tax increase on the value of property that will raise $80 million at the end of the first year. Property values are estimated to grow at a...

-

In a survey of 1040 U.S. adults, 478 believe the government should be able to access encrypted communications when investigating crimes. Let p be the population proportion for the situation. Find...

-

1.1 Indonesia is it potential as a market for Apple? 2.1 Examination of Apple's entry strategy into the international market? 2.2 Evaluation of the entry mode(s) employed by Apple and their...

-

Dynamic, a global media agency, has recently taken over MediaHype, a local agency in Melbourne, to expand its Australian operations. Jeff Tan, a Chinese national, has been appointed to head the new...

-

Linear optimization models play a crucial role in improving supply chain management efficiency, both in physical and abstract network problems. Three ways they can be applied are through optimizing...

-

When I consider optimizing the portfolio allocation for both my 403(b) and CALSTRS retirement accounts, I find it crucial to employ a well-structured model to ensure that my investments align with my...

-

How can you use your understanding of diversity to develop your relationship-building skills in your healthcare career?,Explain ways in which religion can help or hinder individuals as they build...

-

Why are manufacturers usually sued for negligence rather than for breach of contract? Why is an action in contract preferable for the victim?

-

1. Following are information about Alhadaf Co. Cost incurred Inventory Purchases Sales Adverting expense Salary Expense Depreciation Beginning Inventory Ending Inventory Amount 118,000 350.000 90,000...

-

Lolastar Co. is evaluating two competing investment projects. They both require an investment of $25 million. The company cost of capital is 10 percent for projects of this type. The expected cash...

-

Rollon Inc. is comparing the operating costs of two types of equipment. The standard model costs $50,000 and will have a useful life of four years. Operating costs are expected to be $4,000 per year....

-

The Global Chemical Company (GCC) uses the following criteria to make capital investment decisions: 1. Effect on earnings per share (must be positive) 2. Payback period (must be less than six years)...

-

3. The nominal interest rate compounded monthly when your $7,000 becomes $11,700 in eight years is ________

-

An investor can design a risky portfolio based on two stocks, A and B. Stock A has an expected return of 21% and a standard deviation of return of 39%. Stock B has an expected return of 14% and a...

-

Advanced Small Business Certifica Drag and Drop the highlighted items into the correct boxes depending on whether they increase or decrease Alex's stock basis. Note your answers- you'll need them for...

Study smarter with the SolutionInn App