Account for capital and revenue expenditures (expenses) and calculate depreciation expense. (LO 2, 4) Sharper Company operates

Question:

Account for capital and revenue expenditures (expenses) and calculate depreciation expense. (LO 2, 4)

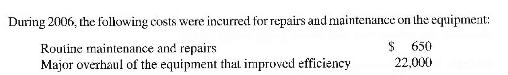

Sharper Company operates a small repair facility for its products. At the beginning of 2006, the accounting records for the company showed the following balances for its only piece of equipment, purchased at the beginning of 2004:

The company uses the straight-line method, and it now estimates the equipment will last for a total of 11 years with \(\$ 5,000\) estimated salvage value. The company's fiscal year ends on December 31 .

a. How much depreciation did Shaper Company record on the equipment at the end of 2005 ?

b. After the overhaul at the beginning of 2006 , what is the remaining estimated life of the equipment?

c. What is the amount of depreciation expense the company will record for 2006?

Step by Step Answer: