Analyze effect of cost flow method on financial statements and inventory turnover ratio. (LO 2, 4, 6)

Question:

Analyze effect of cost flow method on financial statements and inventory turnover ratio. (LO 2, 4, 6)

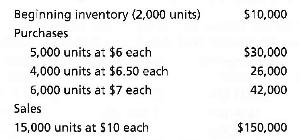

Castana Company is considering changing inventory cost flow methods. Castana's primary objective is to minimize their tax liability. Currently, the firm uses weighted average cost. Data for 2007 are provided.

Operating expenses were \(\$ 12,000\) and the company's tax rate is \(25 \%\).

\section*{Required}

a. Prepare the income statement for 2007 using each of the following methods:

1. FIFO 2. LIFO

b. Which method provides the more current balance sheet inventory balance at December 31, 2007? Explain your answer.

c. Which method provides the more current cost of goods sold for the year ended December 31, 2007? Explain your answer.

d. Which method provides the better inventory turnover ratio for the year? Explain your answer.

e. In order to meet Castana's goal, what is your recommendation to Castana Company? Explain your answer.

Step by Step Answer: