Calculate the return on assets and return on equity for the following companies. What appears to be

Question:

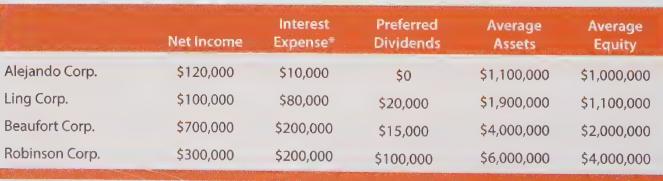

Calculate the return on assets and return on equity for the following companies. What appears to be the average interest rate faced by the companies? As a broad generalization, which companies appear to be effectively utilizing debt to improve financial performance?

* Note: Many analysts use the "after tax" cost of interest (i.e., \($1\) of interest only costs \($0.75\) if a company faces a 25% tax rate) in calculating the return on assets. The idea is to determine how much higher income would be without the interest impact. For purposes of this problem you may simply use the interest expense shown.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: