Hanxhari Ltd has a policy of revaluing its motor vehicles to fair value. The details at 30

Question:

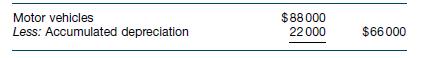

Hanxhari Ltd has a policy of revaluing its motor vehicles to fair value. The details at 30 June 2020 relating to Hanxhari Ltd’s motor vehicles, which had previously been revalued upwards by $7000, are as follows.

At the date of the revaluation increase (1 July 2019) the vehicles had a zero residual value and a useful life of 4 years. Depreciation has been calculated using the straight‐line method. On 31 December 2020, Hanxhari Ltd was informed that the fair value of the vehicles was $50 000.

The useful life and residual value have not changed. At 30 June 2021, the carrying amounts are not materially different from fair values.

Required

(a) Prepare the necessary general journal entries at 31 December 2020.

(b) Calculate depreciation expense at 30 June 2021.

(c) How would the motor vehicles be shown in financial statements at 30 June 2021?

Step by Step Answer:

Financial Accounting

ISBN: 9780730363217

10th Edition

Authors: John Hoggett, John Medlin, Keryn Chalmers, Claire Beattie, Andreas Hellmann, Jodie Maxfield