Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Rockwell Ltd has a policy of revaluing its motor vehicles to fair value. The details at 30 June 2023 relating to Rockwell Ltd's motor

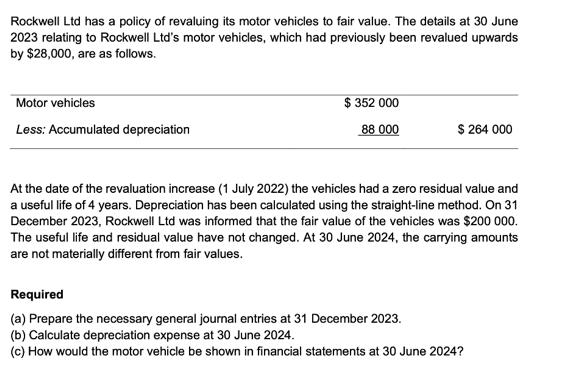

Rockwell Ltd has a policy of revaluing its motor vehicles to fair value. The details at 30 June 2023 relating to Rockwell Ltd's motor vehicles, which had previously been revalued upwards by $28,000, are as follows. Motor vehicles Less: Accumulated depreciation $ 352 000 88 000 $ 264 000 At the date of the revaluation increase (1 July 2022) the vehicles had a zero residual value and a useful life of 4 years. Depreciation has been calculated using the straight-line method. On 31 December 2023, Rockwell Ltd was informed that the fair value of the vehicles was $200 000. The useful life and residual value have not changed. At 30 June 2024, the carrying amounts are not materially different from fair values. Required (a) Prepare the necessary general journal entries at 31 December 2023. (b) Calculate depreciation expense at 30 June 2024. (c) How would the motor vehicle be shown in financial statements at 30 June 2024?

Step by Step Solution

★★★★★

3.25 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

a Journal Entries at 31 December 2023 On 31 December 2023 the fair value of the motor vehicles was 2...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started