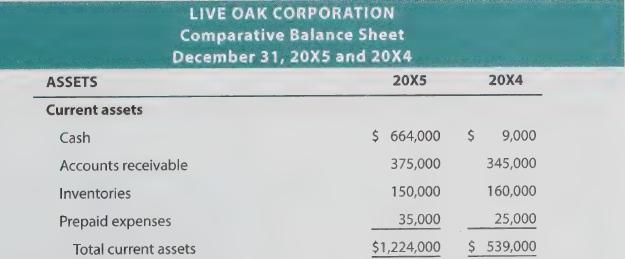

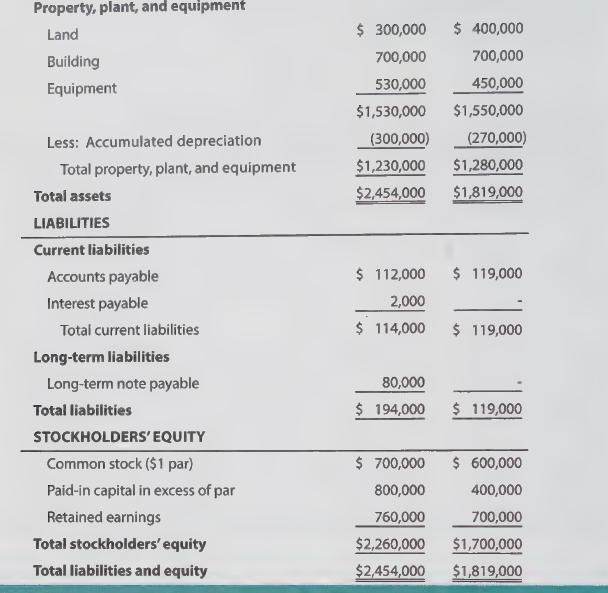

Live Oak presented the following comparative balance sheet: Additional information about transactions and events occurring in 20X5

Question:

Live Oak presented the following comparative balance sheet:

Additional information about transactions and events occurring in 20X5 follows:

Dividends of $55,000 were declared and paid.

Accounts payable and accounts receivable relate solely to purchases and sales of inventory.

Prepaid items related only to advertising expenses.

The decrease in land resulted from the sale of a parcel at a $45,000 loss. No land was purchased during the year. Equipment was purchased during the year in exchange for a promissory note payable. No equipment was sold.

The increase in paid-in capital resulted from issuing additional shares for cash.

The income statement for the year ending December 31, 20X5, included the following key amounts:

Prepare a cash flow statement worksheet similar to the one illustrated in the text. Use the worksheet to prepare the statement of cash flows under the indirect approach. Be sure to include supplemental information about noncash investing/financing activities, and information about cash paid for interest and taxes.

Step by Step Answer: