Record adjustments and calculate net income. (LO 1, 2, 3, 4) The records of RCA Company revealed

Question:

Record adjustments and calculate net income. (LO 1, 2, 3, 4)

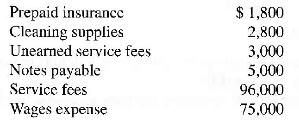

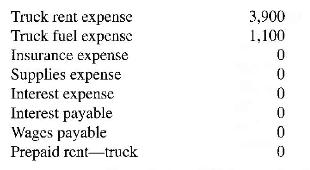

The records of RCA Company revealed the following recorded amounts at December 31, 2006, before adjustments:

Before RCA prepares the financial statements for the business, adjustments must be made for the following items:

1. The prepaid insurance represents an 18-month policy purchased early in January.

2. A physical count on December 31 revealed \(\$ 500\) of cleaning supplies on hand.

3. On December 1 , a customer paid for 3 months of service in advance.

4. The truck rent is \(\$ 300\) per month in advance. January 2007 rent was paid in late December 2006 .

5. The bank loan was taken out October 1. The interest rate is \(12 \%\) ( \(1 \%\) per month) for 1 year.

6. On Wednesday, December 31 , the company owed its employees for working 3 days. The normal workweek is 5 days with wages of \(\$ 1,500\) paid at the end of the week.

\section*{Required}

a. For each item, show the adjustment in the accounting equation.

b. Prepare an income statement for the year ended December 31, 2006, for RCA Company.

Step by Step Answer: