Question:

Track Rack is a software development company that specializes in developing information systems to account for inventory. The company maintains an attractive website, which is one of its primary marketing vehicles. The marketing department has suggested adding a "frequently asked questions" section to the website. The section is intended to focus on general inventory accounting concepts. By so doing, visitors will come to the website to learn about inventory accounting. Based on a visitor's pattern of clicks, pop-up adds will be triggered featuring specific software solutions that may be suitable to help the visitor with accounting issues they face.

The marketing department prepared the following list of "questions" they felt would trigger interest in a particular software product. An inexperienced staffer drafted the proposed "answers". Your job is to review the FAQs below, and suggest necessary corrections or clarifications related to each proposed answer.

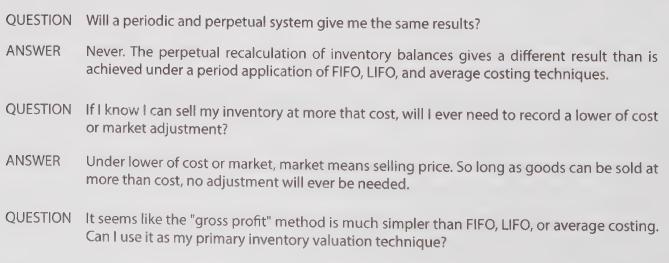

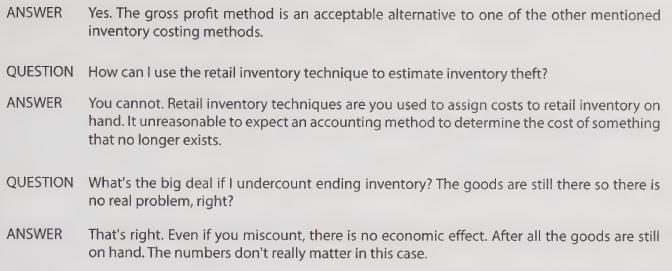

Transcribed Image Text:

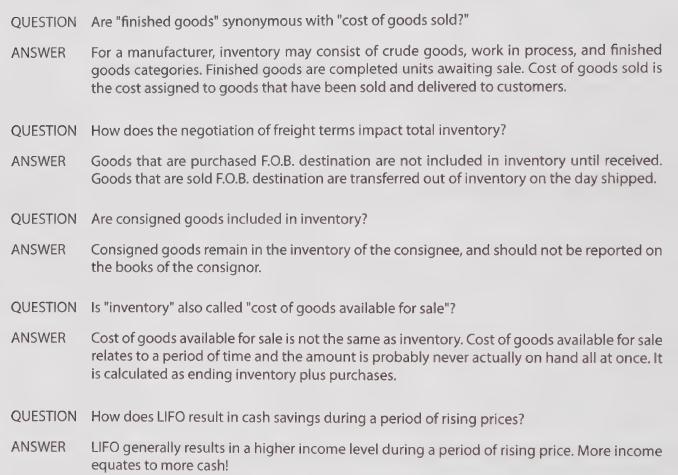

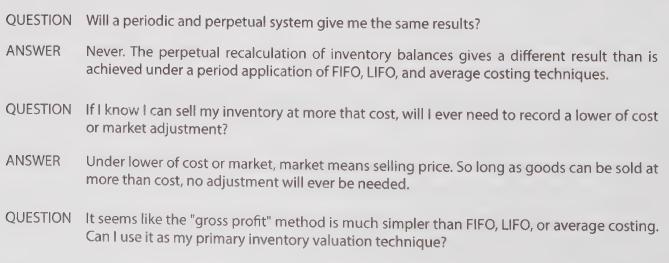

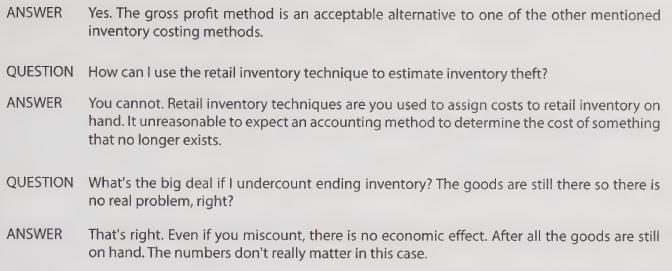

QUESTION Are "finished goods" synonymous with "cost of goods sold?" ANSWER For a manufacturer, inventory may consist of crude goods, work in process, and finished goods categories. Finished goods are completed units awaiting sale. Cost of goods sold is the cost assigned to goods that have been sold and delivered to customers. QUESTION How does the negotiation of freight terms impact total inventory? ANSWER Goods that are purchased F.O.B. destination are not included in inventory until received. Goods that are sold F.O.B. destination are transferred out of inventory on the day shipped. QUESTION Are consigned goods included in inventory? ANSWER Consigned goods remain in the inventory of the consignee, and should not be reported on the books of the consignor. QUESTION Is "inventory" also called "cost of goods available for sale"? ANSWER Cost of goods available for sale is not the same as inventory. Cost of goods available for sale relates to a period of time and the amount is probably never actually on hand all at once. It is calculated as ending inventory plus purchases. QUESTION How does LIFO result in cash savings during a period of rising prices? ANSWER LIFO generally results in a higher income level during a period of rising price. More income equates to more cash!