Deferred Tax (Appendix) Erinn Corporation has compiled its 2008 financial statements. Included in the Long-Term Liabilities category

Question:

Deferred Tax (Appendix)

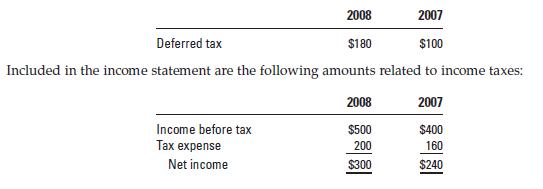

Erinn Corporation has compiled its 2008 financial statements. Included in the Long-Term Liabilities category of the balance sheet are the following amounts:

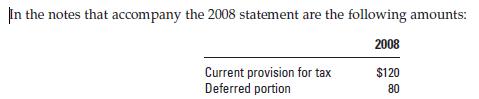

Required 1. Prepare the journal entry in 2008 for income tax expense, deferred tax, and income tax payable.

2. Assume that a stockholder has inquired about the meaning of the numbers recorded and disclosed about deferred tax. Explain why the Deferred Tax liability account exists. Also, what do the terms current provision and deferred portion mean? Why is the deferred amount in the note $80 when the deferred amount on the 2008 balance sheet is $180?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial Accounting The Impact On Decision Makers

ISBN: 9780324655230

6th Edition

Authors: Gary A. Porter, Curtis L. Norton

Question Posted: