Deferred Tax Calculations (Appendix) Wyhowski Inc. reported income from operations, before taxes, for 20062008 as follows: When

Question:

Deferred Tax Calculations (Appendix)

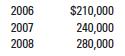

Wyhowski Inc. reported income from operations, before taxes, for 2006–2008 as follows:

When calculating income, Wyhowski deducted depreciation on plant equipment. The equipment was purchased January 1, 2006, at a cost of $88,000. The equipment is expected to last three years and have an $8,000 salvage value. Wyhowski uses straight-line depreciation for book purposes.

For tax purposes, depreciation on the equipment is $50,000 in 2006, $20,000 in 2007, and $10,000 in 2008. Wyhowski’s tax rate is 35%.

Required 1. How much did Wyhowski pay in income tax each year?

2. How much income tax expense did Wyhowski record each year?

3. What is the balance in the Deferred Income Tax account at the end of 2006, 2007, and 2008?

Step by Step Answer:

Financial Accounting The Impact On Decision Makers

ISBN: 9780324655230

6th Edition

Authors: Gary A. Porter, Curtis L. Norton