E7-16A. (Learning Objectives 1, 2: Allocating costs to assets acquired in a lump-sum purchase; disposing of a

Question:

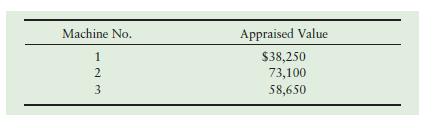

E7-16A. (Learning Objectives 1, 2: Allocating costs to assets acquired in a lump-sum purchase; disposing of a PPE) Goodwood Manufacturing bought three used machines in a $154,000 lump-sum purchase. An independent appraiser valued the machines as shown in the table.

What is each machine’s individual cost? Immediately after making this purchase, Goodwood sold machine 2 for its appraised value. What is the result of the sale? (Round decimals to three places when calculating proportions, and use your computed percentages throughout.)

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial Accounting International Financial Reporting Standards Global Edition

ISBN: 9781292211145

11th Edition

Authors: Charles T. Horngren, C. William Thomas, Wendy M. Tietz, Themin Suwardy, Walter T. Harrison

Question Posted: