P12-55A. (Learning Objective 4: Using ratios to evaluate a share investment) Comparative financial statement data of Bloomfield

Question:

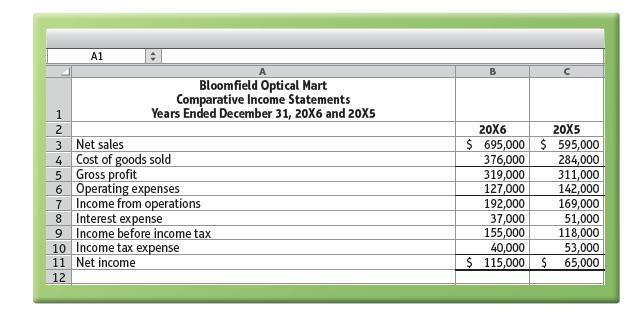

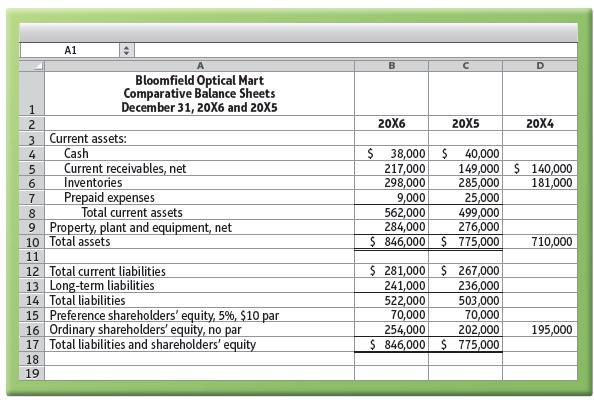

P12-55A. (Learning Objective 4: Using ratios to evaluate a share investment) Comparative financial statement data of Bloomfield Optical Mart follow:

Other information:

1. Market price of Bloomfield ordinary share: $82.20 at December 31, 20X6, and $52.96 at December 31, 20X5.

2. Ordinary shares outstanding: 20,000 during 20X6 and 18,000 during 20X5.

Requirements 1. Compute the following ratios for 20X6 and 20X5:

a. Current ratio

e. Return on common shareholders’ equity

b. Inventory turnover

f. Earnings per share

c. Times-interest-earned ratio g. Price/earnings ratio

d. Return on assets 2. Decide whether

(a) Bloomfield’s financial position improved or deteriorated during 20X6 and

(b) the investment attractiveness of Bloomfield’s ordinary shares appears to have increased or decreased.

3. How will what you have learned in this problem help in the evaluation of an investment?

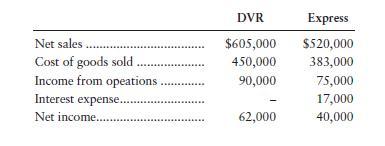

P12-56A. (Learning Objectives 4, 5: Using ratios to decide between two share investments;

measuring economic value added) Assume that you are considering purchasing shares as an investment. You have narrowed the choice to DVR.com and Express Shops and have assembled the following data.

Selected Income Statement data for the current year:

Selected Balance Sheet and market price data at end of current year:

Selected Balance Sheet data at beginning of current year:

Your strategy is to invest in companies that have low price/earnings ratios but appear to be in good shape financially. Assume that you have analyzed all other factors and that your decision depends on the results of ratio analysis.

Requirements 1. Compute the following ratios for both companies for the current year and decide which company’s shares better fit your investment strategy.

a. Acid-test ratio

e. Times-interest-earned ratio

b. Inventory turnover

f. Return on ordinary shareholders’ equity

c. Receivables resident period g. Earnings per ordinary share

d. Debt ratio h. Price/earnings ratio 2. Compute each company’s economic-value-added (EVA®) measure and determine whether the companies’ EVA®s confirm or alter your investment decision. Each company’s cost of capital is 10%. Use unadjusted net income in your calculations.

Step by Step Answer:

Financial Accounting International Financial Reporting Standards Global Edition

ISBN: 9781292211145

11th Edition

Authors: Charles T. Horngren, C. William Thomas, Wendy M. Tietz, Themin Suwardy, Walter T. Harrison