P1-59A. (Learning Objectives 3, 4: Preparing an Income Statement, a Statement of Changes in Equity and a

Question:

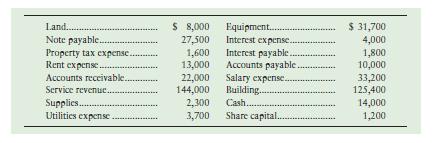

P1-59A. (Learning Objectives 3, 4: Preparing an Income Statement, a Statement of Changes in Equity and a Balance Sheet; using accounting information to make decisions) The assets and liabilities of California Rollers, as of December 31, 20X6, and revenues and expenses for the year ended on that date follow.

Beginning retained earnings was $116,000, and dividends totaled $41,600 for the year.

Requirements 1. Prepare the Income Statement of California Rollers for the year ended December 31, 20X6.

2. Prepare the company’s statement of changes in equity for the year.

3. Prepare the company’s Balance Sheet at December 31, 20X6.

4. Analyze California Rollers by answering these questions:

a. Was California Rollers profitable during 20X6? By how much?

b. Did retained earnings increase or decrease? By how much?

c. Which is greater, total liabilities or total equity? Who owns more of California Rollers’

assets, creditors of the company or the company’s shareholders?

Step by Step Answer:

Financial Accounting International Financial Reporting Standards Global Edition

ISBN: 9781292211145

11th Edition

Authors: Charles T. Horngren, C. William Thomas, Wendy M. Tietz, Themin Suwardy, Walter T. Harrison