P2-70B. (Learning Objectives 1, 2, 3: Analyzing transactions; understanding how accounting works; journalizing transactions) Smith Real Estate

Question:

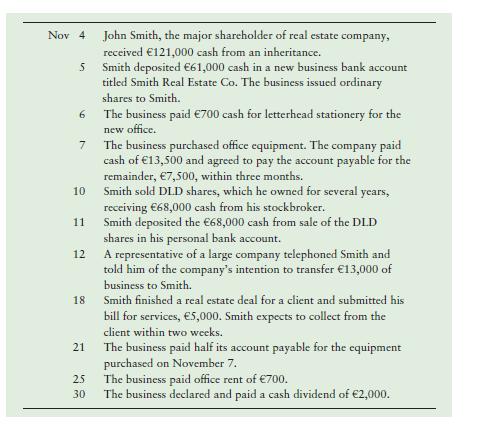

P2-70B. (Learning Objectives 1, 2, 3: Analyzing transactions; understanding how accounting works; journalizing transactions) Smith Real Estate Co. experienced the following events during the organizing phase and its first month of operations. Some of the events were personal for the shareholders and did not affect the business. Others were transactions of the business.

Requirements 1. Classify each of the preceding events as one of the following:

a. A business-related event but not a transaction to be recorded by Smith Real Estate Co.

b. A business transaction for a shareholder, not to be recorded by Smith Real Estate Co.

c. A business transaction to be recorded by the Smith Real Estate Co.

2. Analyze the effects of the preceding events on the accounting equation of Smith Real Estate Co.

3. Record the transactions of the business in its journal. Include an explanation for each entry.

Step by Step Answer:

Financial Accounting International Financial Reporting Standards Global Edition

ISBN: 9781292211145

11th Edition

Authors: Charles T. Horngren, C. William Thomas, Wendy M. Tietz, Themin Suwardy, Walter T. Harrison